Into Our Fourth Year of Financial Freedom – The Story so Far

Just over three years ago, a tenant moved into the house we’d just spent a year living in and renovating. When their first month’s rent came in, along with our other ‘passive’ income streams, we reached a tipping point. We were both aged 43 at the time, and had just reached financial freedom / financial independence / retirement – different people call it different things. From that point on we’d enough investment income to remove the need for either of us to ever work again (probably – there are no guarantees in life). This post looks at how this unusual lifestyle decision has played out for us so far.

Before we start, we might be able to quickly answer some of your questions as to how we got into that position in the first place. Over the past three years enough folks have expressed interest in how we managed to ‘retire’ so early that we wrote a ‘mini guide’ eBook called Funding Freedom. It’s been downloaded a few thousands times. It’s nothing like a ‘how to’ manual, it’s far too short for that, but covers off some of the more common queries. You can download it for free here for Kindle or here in other formats.

The Money Stuff

Right – let’s quickly talk cash. Cutting to the chase, we’re more financially secure now than we were when we quit work. This is how:

- Our rental properties have been almost fully occupied.

- The sun’s shone on our two roof-mounted solar arrays.

- Our share funds have continued to pay dividends.

- Our bonds have thrown off some interest.

- We’ve (shock, horror) done some paid work, which has bumped up our bank balance.

- And finally we still live below our means. Even in ‘retirement’ we save and invest around 25% of our post-tax income.

So, enough cash has flowed in to pay the bills, and enable us to have fun. Our assets are mostly appreciating in value, to fend off the effects of inflation. We’re also a few years closer to being able to access our private pensions. These aren’t huge, but will further secure us in about 9 years time. In theory we’ll get state pensions in 2039, 21 years from now, and are currently still paying NI contributions towards them, although we suspect this pension might be means-tested by the time we’re 67.

As stated above, there are no guarantees, and we’ve a few strategies up our sleeves to cope with unexpected difficulties:

- Our income comes from roughly 10 different places and, as we don’t spend all of it at present, we can easily handle a few of ’em drying up at any one time.

- We hold a fairly large emergency fund in cash and bonds, which we can quickly access in the event of a big outlay being necessary.

- We have the option of using the motorhome to further reduce our costs – by renting out the room we’ve retained at home in the UK and staying at free aires in France, for example.

- In extreme circumstances, we could go live in Thailand or somewhere equally low-cost, to ride out the storm.

- And of course we could simply look for paid work in the UK, or set up a small business of our own. Our skills will age as we do, but we’re both able to think rationally, and we **should** be capable of working for another 20 years at least.

The Fun Stuff

Over the course of the past three years, we’ve spent 24 months on four tours of Europe and Morocco in our motorhome, heading as far south as Icht on the edge of the Sahara and as far north as Nordkapp in the Norwegian Arctic. This, as you might imagine, has been a lot of fun.

We’ve done some exercise too, with Ju completing her first half marathon in Marrakech and me pulling in some charity cash running up a big hill in Switzerland. As a general point, our focus on physical well-being’s hugely improved since quitting work.

The Not-So-Fun Stuff

It’s not all been plain sailing though, of course! We’ve had a few rough patches over the years as we’ve made this huge change in lifestyle. I’ve been the main culprit here, as I struggled to relax into a counter-cultural way of living. Anxiety was the main issue for me, which I’ve eventually defeated through a combination of exercise and reminding myself that life is too short to worry about the opinions of others. It took me around 2 years to stop feeling guilty about not being at work.

Another reminder of the shortness of life was our wee pooch Charlie passing away this summer. He slowly declined over his final years, which was a source of continual worry. His passing wasn’t the relief we thought it might be in our darker moments, it was just dreadfully sad. We miss him, we miss being ‘pooch parents’, but won’t commit another 10 or 15 years to another dog just yet, there are other things we want to do first.

Paying it Forwards

We were extremely lucky to meet folks seven years ago who opened our eyes to other ways of living, where we spent less, invested and enjoyed life more. It seems appropriate and fair that we should do likewise, and encourage anyone thinking of doing something similar.

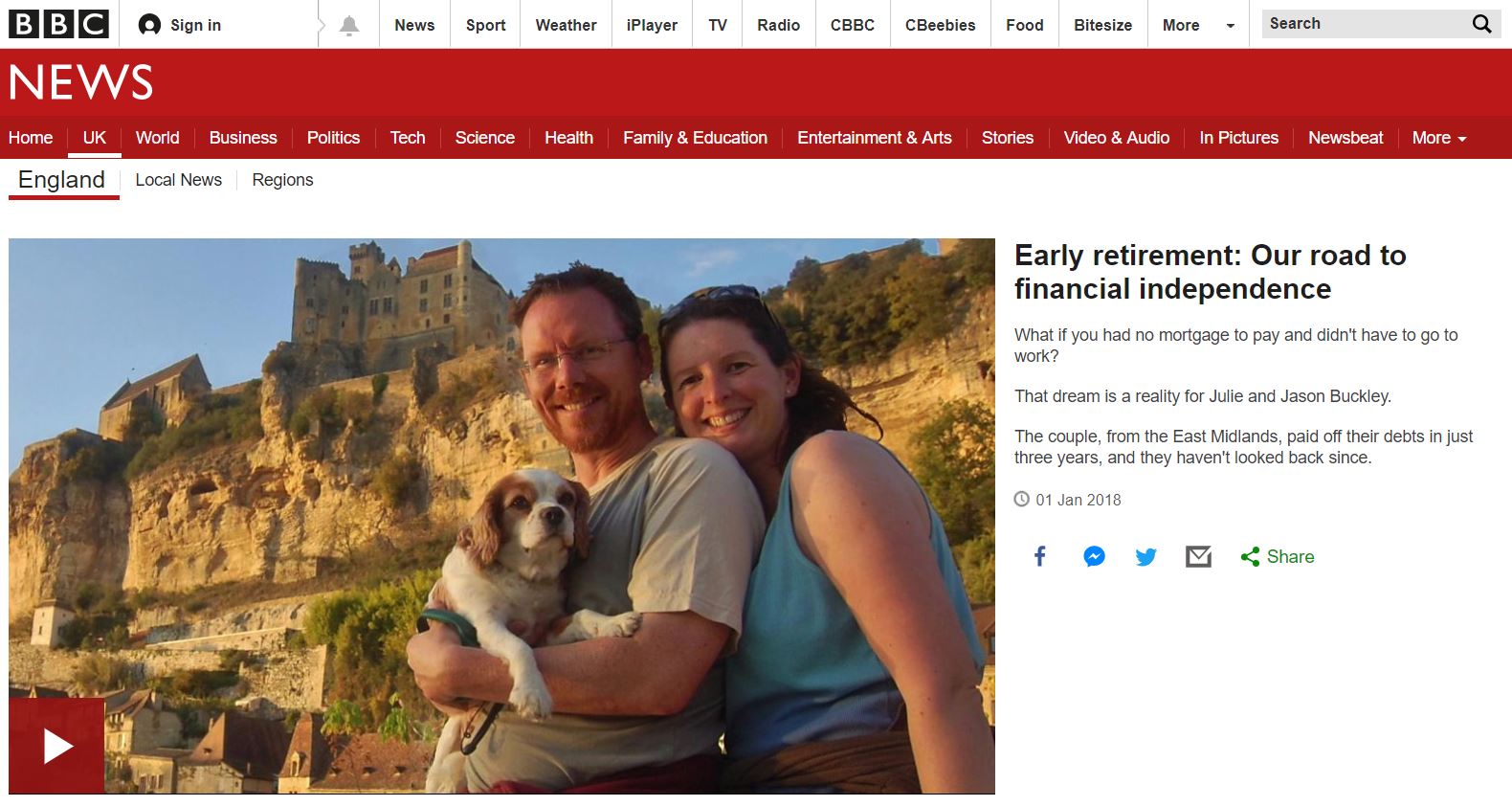

Over the past three years, as well as publishing Funding Freedom, we’ve written a few posts on OurTour.co.uk, and contributed bits and bobs to various media outlets, starting with local newspapers and radio. After that we were (briefly) on Channel 4’s ‘How to Retire at 40’ (which turned out to be dire), with a supporting article in the Daily Mail. Finally we ‘topped out’ by being in a video on the national BBC website about ‘Our 30 Year Retirement‘ which went live in 1 January and attracted something like a million views.

I say ‘topped out’, as we’ve made the call not to do any more of that ‘mainstream’ stuff. The message we’re trying to get across is simple really: spend less, save money, invest, simplify, live life on your terms. Does this message go down well with the general public? Nope, the online comments are clear on that point. Can journalists, who themselves are waged, not personal finance enthusiasts, and under time pressure to get articles out, do an interesting, even-handed and accurate job of writing about the subject? Not really, not from what we’ve seen.

I also had a stab at being a financial independence blogger a couple of times, but it just didn’t float my boat (you can see the all the posts in the money section of this blog). Being honest, I’m not all that interested in personal finance myself, just enough to enable us to live the way we want to live, and the blogs didn’t go anywhere as a result. There are some fantastic blogs already out there though, have a look at the links at the end of this post.

How are we Feeling about Financial Freedom?

Our feelings over the past three years have both differed between the two of us, and have changed over time. In terms of cold, hard doubt about whether our financial plan would work, I probably had more of that than Ju, being more of a pessimist. Neither of us are much worried about it at this point in time though. We keep a close eye on our spending still, tracking each pound and penny coming in and going out, which we review together monthly.

Perhaps the biggest surprise for us was the level of anxiety having a ‘blank page’ presented to us would induce. We never really thought of it while working, but the need to dedicate 50 hours each week to the office was a subliminal excuse for not doing things we really should do (since we only live once), but might be otherwise afraid to do. Suddenly having this open future in front of us was difficult to handle. To accept that we’re not Tim Ferris or Tony Robbins, to accept that it’s OK not to be chasing every possible goal in the world, took a while.

It’s certainly an odd life we have. Each day has the same value: no more do we await Fridays or dread Mondays, or mildly celebrate ‘hump day’ Wednesdays. We live ‘off peak’, so don’t drive in rush hour or shop at the weekend. We can exercise when we want: sometimes I’m in the gym at 7am, sometimes 3pm, depending on when I wake up and how I feel. We have no bosses to boss us around, and no office politics to wind us up. The few TV adverts we get to see look simply bizarre through our eyes: why would you want to buy *this shiny thing* when life is so much simpler and fulfilling without it?

Yep, we’re odd. Do we enjoy this quirky life though? Oh yes. Would we go back to corporate jobs? No chance.

What’s Next?

Good question! We’re currently at home in Nottingham in the UK. Ju’s editing our next book, The Motorhome Touring Handbook, which aims to sum up all the practical stuff we’ve learned about touring the UK and Europe over the years. Once that’s done we’ll get it proofed and published, hopefully later in September.

I’m pottering about like a retired old gent! One that spends an hour or three a day training that is. I’m booked onto the July 2019 Zermatt Ultra Marathon, a 29 mile uphill run, climbing a vertical mile to Gornergrat at over 3000m. As I’ve never run more than 22 miles on the flat at sea level (and that was 20 years ago), I’ve got a job on. A while back, I realised I need this kind of challenge to keep me mentally healthy.

In terms of travel, we’ve a few short trips lined up, including a nip south to Cornwall with our mates and their fab nippers, and a jaunt up to Scotland in Zagan to see an old mate of mine. If the weather holds, we’ll spend a few days nipping round the North Coast 500. We’ve invested in a copy of the Lonely Planet Guide to Sri Lanka too, thinking we could nip there for 2 or 3 months over the winter. As yet we haven’t managed to decide whether or not to do it. Yep, versus staying in cold, dark, snowy Blighty, Sri Lanka might sound no contest, but we’re quite liking being at home for a while.

More In-Depth Information

If financial freedom’s something you’re curious about, there are a number of fantastic free and paid resources out there to help you. In the USA, the Money Money Mustache (MMM) blog is perhaps the single biggest influencer in this area (competing with the likes of Early Retirement Extreme and The Financial Samurai). The UK ‘equivalent’ to MMM is The Escape Artist, entertaining, and written by an accountant who retired at 43 with 3 kids. None of these blogs pull any punches by the way, unlike the mainstream media.

I also found Meaningful Money to be a fantastic free resource, with Pete (a UK-based certified financial planner) using short videos to explain lots of mystical subjects like pensions, ISAs and income tax in layman’s terms (he’s publishing a book too if you want all the info in your hands).

In terms of other books, there are a ton of great resources out there; here are a few of the very best. I’ve read all of these except ‘The Simple Path to Wealth’, as most (if not all) of the information is available for free on the author’s jlcollinsnh blog (his Stock Series of posts is well worth a read).

And Finally

Getting to the point of financial independence in your 40’s (or even 30’s, as some of the above bloggers have done) is hard work, and certainly not for everyone. For us, it required a degree of luck (we’ve both enjoyed good health, have supportive parents, had education and job opportunities and were lucky to be born into the world’s 5th biggest economy). No, we don’t have children either, but that didn’t feature in our FI plans, it just happened to be that we didn’t want a family. Most of the other FI bloggers I’ve given links to above do have kids.

This whole thing still wasn’t easy, but there are far, far harder things in this world. Life for us is good, let’s see where the next three years take us!

Cheers, Jay

Excellent summary of your journey, it’s still inspiring though I’ve already read through most of your blogs.

Visit Isle of Skye in Scotland if you get the chance. It’s the equivalent of paradise in my mind. 😊

Cheers Swathi – totally agree – we visited Skye and Mull in our campervan before starting this blog, both beautiful. Cheers, Jay

If that doesn’t push a few ‘off the fence’ (ooo that sounds brilliant, I’ve always wanted to do that) then nowt will. Great post.

Wayne at Chucklebus.

:-) cheers Wayne – see you soon fella! Jay

You guys are an inspiration for how to do it. While we’re chasing a different form of FIRE, including a permanent move from the UK which has driven us to invest differently at a high level, I agree it really isn’t much more complicated than the principles you mention: “spend less, save money, invest, simplify, live life on your terms”. To that list I’d add earn more pre-FIRE, minimise investment expenses and minimise taxes. The main investment difference for us is we wanted no direct assets that were bolted to the ground making the world our oyster. That meant a plan to live 100% off the dividends from bonds/REIT’s/equities. I’ve achieved that with some head room meaning like yourselves we should also be adding new money to our investments in the good times.

So I’m now working my notice period and we’ll be permanently in the Med before the grim UK winter descends. My initial plan for decompression is to set-up our new home which I’m sure will include a little renovation and like your good self get back to peak fitness.

Good luck with year 4!

Thanks RIT, appreciate the positive words!

Yep – agree with your points – I guess my views on FIRE have softened over the years and I try to keep the message as simple as possible. I see early ‘full FI’ as something which most of the population cannot achieve, even if they wanted to. My own father came from a childhood of deprivation, abuse and poverty, and worked tirelessly to get to a point of giving his family a good life. He simply couldn’t have done what he’s enabled me to do – it was already an utter miracle him and mum pulled off an escape from the poverty trap – zero chance of retiring in their 40s. It effectively took two generations for to me to get here, not just a few short years.

My view’s now that the tenets of the lifestyle we have are applicable to many people, if not the end goal. I appreciate a ‘story’ like ours can help to motivate some folks to have a crack at it themselves, but really this message is a very, very simple one: spend less of your hard-earned money on stuff you really don’t need folks. That’s it. Even if you don’t invest it you’ll experience incredible gains in freedom. Some of you won’t be able to do that, as all your money is being spent on true essentials, in which case you have to either accept your position (don’t, you only live once), or work to better yourself (hard, but worth it). It’s a very dull, boring message in the end, no glamour.

100% dividends sounds beautifully safe my friend, you’re in a wonderful position, congratulations! Enjoy that decompression! As noted into the post above, I had a few issues with mentally accepting my new ‘position’ in society post FIRE, although that mainly appeared as a problem while in the UK. Perhaps by you shifting abroad quickly you won’t experience the same challenge. Either way, enjoy it, you’ve put in the thought and effort to pull it off.

Cheers, Jay

“…spend less of your hard-earned money on stuff you really don’t need folks.” IMHO that is the most important of them all and it’s not exactly a new concept either. What was Wilkins Micawber’s famous saying way back in 1850 or so – “Annual income twenty pounds, annual expenditure nineteen [pounds] nineteen [shillings] and six [pence], result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery.” After that any additional saving, whether by earning more or spending less, accelerates your life to whatever option one desires. Make it to aggressive saving levels, some might call it extreme, and that enables FIRE.

Thanks for the wishes re decompression. A little concerned about it as I know that it took me a while to pull the FIRE trigger having been FI a while and I know part of it was because of institutionalisation.

Thankyou for this post. Ive been following your blog for a while now and enjoying it. I’m 55 and although not financially independent I’m better off than most in that the mortgage is paid and i dont have a particularly extravagant or profligate lifestyle. Ive had a couple of loooong breaks from the treadmill but i think its time to start looking at a permanent break, so going to start looking at some of those resources youve been posting. I feel a new file of all this starting and this blog post is the first thing in it!!!

Do as many of the physical this while you are still young. My husband was 58 when we retired 19 years ago, he has cycled across Europe with me driving the motor home we have also been to Nepal walked around Anuporna went to Everest base camp, walked GR trails and long distance paths is UK Australia and New Zealand. Did all that while we could now aged 68 and 77 we are taking things a bit easier walked most of the Caminos last one we did was in May,the Tunnel route from San Sebastian, we now travel doing round in our MH doing walks when we can, take cruises. We are off to China next year. There is so much out there to do and we have a similar income to you so not rich but enough. So go for it there will always be people who critise just feel sorry for them they have no joy in their step and are just jealous that they cannot control their spending and don’t have your vision.

Thanks Moira – good advice we reckon! Jay

Always good to read your Blog and get all “fired up” again.

The good news…..I’m retired!!! That was obviously the main tick-in-the-box and it’s done. I’m 56 so a year later than planned. Basically I got to swap with a colleague who was made redundant, but wanted to hang on a few more years. I was going to quit next Spring so the redundancy package offer came as a welcome surprise, out of the blue. That keeps the Wolves from the door until next Spring at least and reduces the stress considerably.

I worked from 16 to 56 with no gaps of unemployment. I did my “shift” and paid PAYE all the way. It’s time for the next stage in life.

Our house is on the market and we’re close to buying a rental property.

My youngest is just about to move out to a place of her own and my eldest flew the nest several years ago.

I withdrew my pension funds from a couple of jobs and will be investing those for some “drawdown” income (This is the biggest risk, my pension is now under my control, the fluctuations of the various markets makes my palms a bit sweaty).

BUT….Plenty of people manage on less than we have accrued and it was my choice to do this. Not many people have the luxury of such a choice.

So it’s all coming together. Life has recently warned us not to plan too far ahead (“If you want to make God chuckle just tell him your plans”).

Of course I blame/thank you both (Jay & Jules) for much my To-Do list but by far the biggest Thank You is for pointing us at the Hymer B544. Honestly we haven’t seen another model that would tempt us away from Humberto. Yes we drool over some huge garages and “Master Bedroom Suites” but we always walk away thinking, “It doesn’t have two Sofas for slouching on..how crap!”

At the risk of planning too far ahead…. my Birthday is late May and I plan to have some cake atop Pulpit Rock in Norway (I thank/blame you for that as well) on our way to Nordkapp (well it seems like a rite of passage doesn’t it? A freezing foggy gravel car park..what’s not to like about that?). The target is to cross to France in March/April and make our way North, with not much of a plan other than Birthday Cake on Pulpit Rock.

Until then though we have many property hassles to contend with (I quit my job to work as a liaison between Estate Agents and Solicitors…oh joy). We may try to go to Normandy for a week if we get a break in house admin soon. Since I’m retired I would like to just sit and stare at the sea for a few days and do bugger all apart from stare.

Until later…cheers

Lee at http://www.gohumberto.com

Great news Lee, and you’re most welcome. Enjoy your freedom fella! Cheers, Jay

Great article and some lovely comments too.

I first found Mr Money Mustache from a link in your blog a while ago, found him inspiring and now retiring at the end of September as hopefully now financially independent.

We have been taking very short local trips in our Burstner and are looking forward to some much longer trips in time and distance. The first is October in and around Wales.

Your Funding Freedom book was also very influential and a great help in getting us to the right mindset.

Before reading your blog we did not track our expenses and your spreadsheet download has been very useful.

Thank you.

Appreciate the feedback Pete, thanks for taking the time to write, enjoy those tours! Jay

Definitely enusure you get your annual free CETV ( Cash Equivalent Transfer Value) from you pension scheme. I also worked for a large European Energy Company (until 2014). Whilst I’m not giving advice about transferring out of a defined benefit scheme you may find it suits your circumstances to consider it. I achieved FI about 5 years ago but I have one more year syndrome. I also have a 4 year old son so my present earnings are being allocated to buying him a house or paying into his pension. I do have the enviable choie of being able to quit any time I like though – which is nice.

Thanks David. Yep, we’re getting the free transfer values. TBH, if that amount was sat in a SIPP in VWRL or some such I’d be very comfortable with it. The act of getting the money out and having to engage an IFA and explain our life is putting me off though! Cheers, Jay

Indeed and I’m yet to find anything that moves as slowly as an actuary getting a CETV figure.

I was in 2 Final Salary schemes and I “transferred out” of both of them at 55 years of age.

My IFA said that poor annuity rates, plus employers desperately wanting to “buy you out” of such schemes mean there are some VERY attractive payouts.

It turns out that, IF your company will “bribe” you to take your money out, you can pretty much earn the same amount of pension at 55 as you would by waiting for the company scheme at 60/63/65… whatever it is. (All this depends on individual circumstances of course. You and Jules don’t have kids so an annuity may make far more sense. We have 2 kids and now they stand to inherit the pension fund. That was a prime motivator for me, to get the money into the family coffers. (What IS a coffer?)

Hi both,

Not about FF but after some advice please. Ian here from Hilma the Hymer – a bit of advice for me if you have the time? Away in France at the moment and didn’t realise the Three SIM only shows downloaded data and not uploaded on the MiFi unit so I ran out of data allowance (doh). Do you buy a local SIM card when travelling in France if you happen to run out of data? Any advice welcome.

Hi Ian. Hmmmmm, as far as I know our Huawei MiFi shows combined upload and download? Anyway, we’d probably just buy more Three data rather than go through the sometimes long process of buying a French SIM. That said, if we were there for another month or two, we’d look into local PAYG SIMs to see if we can get the cost down. Hi to Hilma, enjoy La France! Cheers, Jay

P.S. Up to date PAYG SIM card info here:

http://prepaid-data-sim-card.wikia.com/wiki/France

Thanks Jay,

It was Adam that mentioned the data showing only download. Anyway mangaged to get on a site with free WiFi – which means I can top up the card- yippee. Sad that we are slaves to the internet – but then great that we can share our happiness :-).

We have stayed in 3 France Passion stops on this trip of 18 days. Good stuff – a market gardener, a champagne producer and a chateaux with a lovely old boy and a dog.

Ah! Adam is the man, the guru of all things wandering WiFi so I will of course bow to his superior knowledge, my apologies! Slaves to the Internet? Nah, we could give it up if we really wanted to. Couldn’t we? :-) Those France Passion stops sounds pretty cool, keep sharing the joy, Jay

Oh why does this blog make me want to cry!!!

Fustration that i am not as smart or as brave as you both, your blog is an inspiration and i can only hope that my husband gives me a great big push in the direction of what you two have been doing, really admire you both, keep on blogging

regards Linda

Another 10 Year and we will be free, we love reading your blogs

Keep going Beth, not easy we know but the process of getting here’s transformative, and IMHO, well worth it. Cheers, Jay

Your blog is inspirational, hopefully we will be brave enough to do what you’ve done one day! Although I have already passed the age that you bit the bullet, I’m 45. Kids still at school, Year 9 & Year 13, when they’ve left home who knows. Although I’m thinking more of a part time basis, some time at home and some time travelling in our motorhome.

Hi Ju and Jay,

I’ve been meaning to send this message for a little while to say a HUGE THANK YOU. This may go on a bit so please bear with me!

My husband and I emigrated from the UK to New Zealand 12 years ago and we came across your site when we were planning a year back wandering around Europe (in a campervan which didn’t happen in the end but that’s another long story). Anyway, after 13 months away, we got back to NZ in May and promptly got back in to the work routine – yay (not). In mid-September on a gloomy end of winter Sunday evening, I suddenly thought, “I wonder what Ju and Jay are doing now” and saw this blog post. Whilst I knew you were financially independent, for some reason I’d never looked in to that at all so when I followed the links in this post, I think I yelped when the penny dropped that we had “enough” not just to retIre at 65 but NOW at the ripe old middle age of 55 (him) and getting there 46 (me). After numerous “really!?!” conversations and more research, we assured ourselves that we were indeed financially independent and choices were ours for the taking.

My contract wasn’t going well so I’m now at the start of week 3 of I’m not sure what to call it and it feels unbelievable. I’ve had breaks between jobs before and obviously we had one very loooong holiday with our year off, but it was always on the basis of knowing that a job would be looming at the end, so this just feels completely different. Roger has decided he wants to carry on working as he’s really enjoying his new role and getting lots of satisfaction from it,but at the same time he knows he can change his mind whenever he wants. So at this point we haven’t really got a plan for what the immediate future holds, but knowing that it’s entirely in our hands is enough right now

Since reading this post, I’ve hooked into the online FI/FIRE community in NZ and been listening to tons of podcasts to educate myself the way I should have been doing some time ago!!!

Anyway, I just wanted to let you know what this blog post did for us and how grateful we are. It’s a summer’s evening (after a roasting 29c day) so must be time for a beverage.

Thanks

Suzanne

ps if you find yourselves down this way, make sure you get in touch.

Hi Suzanne

It still amazes me how we can just write to each other on the other side of the Earth like this! It’s just a few degrees on this side, but the sun’s shining and the sky is blue today, which reminds me I need to go and try and track down a leak on the roof, again!

I smiled at the point you wrote about the ‘penny dropping’. We had a similar slack-jawed moment a few years ago.

Momento mori. We’ve all got just so many hours remaining to us on this Earth, and the option to choose how to spend yours is priceless. Congratulations on attaining that choice so early in what will hopefully be long and healthy lives. Seriously, it’s an amazing, empowering and frightening thing having that level of choice, all power to you both.

Thanks for taking the time to write this comment. Reading it is a great start to the week!

Cheers, Jay