End of an Era, and a New Way of Thinking

It’s a strange feeling, sitting alone in Zagan the motorhome, in a field in Derbyshire. It’s raining and I’m on the Camping and Caravan Club Temporary Holiday Site near Carsington Water. It’s only £8 a night (parking for the day at the visitor centre about 200m away is £5) so we’ve splashed out on a week, and may stay even longer.

It was this site, at this time last year, that introduced us to the world of Temporary Holiday Sites. We were staying on one of our favourite sites at Uppertown Farm when loads of caravans and motorhomes arrived in the rally field opposite. We got talking to one of the chaps running it and he explained it was a temporary holiday site and not only was it a couple of quid cheaper than the site we were on, but it had somewhere to put your rubbish. We were sold and joined the club soon after, since then we’ve stayed on several THSs and they have proved really useful for visiting busy places like Kendal in the lake district, in the summer.

After seeing the heatwave weather forecast and realising that our calendar has only a few things that need us to be home over the next few weeks, we decided to head here. It’s only about 20 miles from home, so we’ve brought our car with us to drive back when needed. That’s why I’m on my own in Zagan. Jay has nipped home to catch up with his friends ahead of his BIG birthday next week. Last time we split up while travelling was in the French Alps in 2019 when Jay caught the train back to the UK to do some work for a few days – and I got my first experience of emptying the loo! This time it’s just for a night, so no loo emptying for me, phew.

Having a car on a campsite is a new thing for us. We met Rose and Paul from Australia towards the end of the second year of our year-long trip, who toured with their wonderfully named motorhome Wheredm’daygo and a car (upgrading from a moped after they fell off it in Italy). Paul drove the van, Rose drove the car – we weren’t sure about the efficiency of it all. But then Wheredm’daygo was a big beast and they found it much easier to free park it somewhere quiet away from everything and drive to what they wanted to see. We’ve met other folk who tow their cars, but as Zagan doesn’t have a tow bar and we don’t own a trailer or A-Frame, we’ve opted for the dual-drivers approach.

So far we’ve used it to go for a walk around nearby Harboro Rocks which would have been too far to walk there and back. We also drove over to the local Parkrun in Ashbourne on Saturday morning where Jay came an impressive 4th, and first in his age group. Next week will be his first Parkrun aged 50, so he’ll be one of the youngest in his category – no pressure. Next week we need to drive over to visit my parents and help them with a couple of things, and also find somewhere for a nice meal out for Jay’s birthday. It’s a bit strange having the car here, but I think we’ll get used to it.

Two weeks after we got home from our tour of South Wales, our house sale finally completed. I can’t tell you what a huge relief it was to receive the call to say it was done. Over 14 months ago, when we saw what a state the tenants were keeping the place in, we made the decision to sell it. Since then we’ve had to apply to the courts twice to get possession back and start claiming several months of unpaid rent, all new experiences for us. We also had to spend over six weeks getting it back into a sellable condition, along with a few thousand in costs for repairs, paint, new carpets etc. Here we have to say a massive thank you to Jay’s dad who was there every day helping us, it would have taken a lot longer without him. So maybe you can understand why it felt like a weight had been lifted when the keys were finally handed over. Not that we did the handing over, we decided instead of waiting for the phone to ring, we’d give the keys to the estate agent and then booked ourselves in at the cinema to watch Top Gun Maverick – a very worthy distraction.

Four days after the sale completed the money arrived in our bank account. The Estate Agent and Solicitors took their fees before it reached us, and we’d already worked out how much Capital Gains Tax we’ll have to pay, and what to do with the rest of it. A couple of hours later, and around £40 in transaction fees, all the money had left our accounts and was invested.

When we first started investing in the stock market, I was very sceptical. A house is a nice, physical investment. It’s there, you can touch it, and each month rent pops into your bank account (hopefully) for you to pay the mortgage and/or live on. Shares on the other hand were just numbers on a screen or bits of paper. I’d known companies go under and all their shares wiped out, and I’d met people who had their lives seriously messed up by a stock market bubble bursting. So, we financially educated ourselves (Jay much more than me – he does big picture, I do detail) reading books, blogs and anything we could get our hands on. Then we dipped our toes in the water.

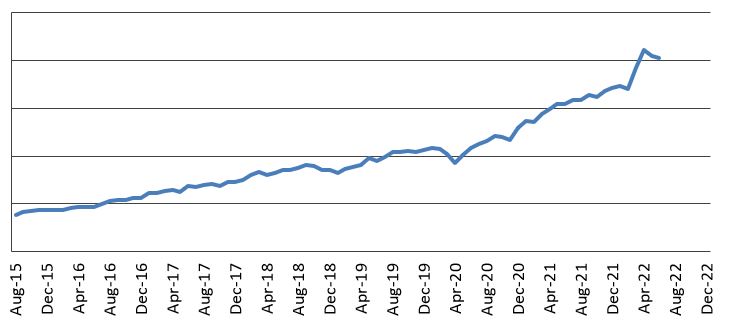

Back in March 2014 we shut our eyes and held our breath as we clicked ‘buy’, spending £2500 on 60 shares in an exchange traded fund (ETF). The fund brought together all the largest companies around the world, enabling us to buy a part of a share in each one. If any one company, a particular sector (like IT or finance) or even a region of the world had an issue, our risk was spread wide and we wouldn’t lose everything. Over the next eight years, we’ve clicked that buy button forty more times. As we generally spend less each month than we earn, the leftover was syphoned off into a savings account and then when it reached a decent amount we bought more tiny bits of a vast range of companies.

We bought into a few other ETFs too, all passive so we weren’t paying someone to try to guess what and when to sell and buy, but instead, just tracking the stock markets. We watched them all rise and fall as the stock market does, we kept note of how much each one paid out in dividends, eventually settling on our favourite ETF which turned out to be the one we bought on that very first trade all those years ago.

In March 2020 when the pandemic hit, we were convinced that our shares would plummet and they surely did. For a surprisingly short time though, then bounced back up. In fact we bought some more when they dipped down, or as we like to call it ‘in the sales’. So now, eight years after starting on this crazy investment journey we have put the money from our house sale into the stock market and I am sleeping much better at night than when we were trying to get back possession of our house. As I write this world-wide stock markets are trending downwards, and if we’d have known we’d have waiting to invest out money, but there is no way of knowing. We could have put it in in small chunks (known as pound cost averaging) but that’s a statistically dubious method as, over time, markets tend to rise over the long term. As we don’t plan to sell any shares for at least the next couple of years, and potentially for another decade if needs be (and even then we’d only sell a small amount), we’ve plenty of time for the next recession to play out.

Don’t get me wrong, renting has been great for us over the years, giving us a steady income while we toured Europe (we paid a letting agent to handle everything for us, sorting out repairs annual safety checks etc). However, new laws and even more proposed changes are making it much less appealing for independent landlords these days, and after the experience we’ve just gone through, the stock market is currently the right thing for us.

Without the rent from the house we won’t be earning more than we spend anymore, which will be a bit of a mind shift – seeing my tracker spreadsheet go from green to red. Instead we’ll take any difference we need from our buffer fund. Once we get an idea of how much we are earning in dividends from the shares, we can calculate how many shares we’ll need to sell each year to cover our spending. Jay has written loads about all of this stuff on this blog, just look at the ‘Inspiration’ section on the top menu or grab a copy of The Simple Path to Wealth.

Over the next few weeks we’ve some stuff that we need to be near home for, and with our parents all needing a bit more support at the moment we aren’t planning to venture far from home. We had put aside some money from the house sale to go to Iceland (the country, not the food store) but after doing some research we decided it’s not for us this year. Instead we’re thinking of maybe going over to Ireland in the van, but as you know with us, plans change on a daily basis, so who knows what we’ll be up to. Don’t worry, we’ll keep blogging and let you know.

Ju x

Enjoy your time at Carsington. Good news about the house. It can be a pain when one tenant causes problems when all the others have been fine. The last tenant in our Cornwall home was difficult to remove and we had to do a lot of work to prep the house to sell, so I feel your pain.

I’m very pleased with our Vanguard Passive Trackers; both have done reasonably well and we always reinvest dividends. It’s a long-term game as you’ll know.

Cheers, Paul

Great news on the house, I am sure it’s been a weight lifted off after seeing it in that state. Nice time to be putting a lump into an ETF too.

Often though of the car idea, but my wife doesn’t really like to drive. I considered towing but it seems to make more sense to use a car to tow a caravan, to me any way. We might go down the route of a caravan (again) for the extra space but not sure.

Pity about Iceland I was looking forward to seeing how you got on, one for the future maybe.

Thanks for the post, good luck.

Simon (I might be able to help you out with some Ireland info.)

Hi Simon, we were chatting with a friend there other day and agreed if we only ever toured the UK we’d seriously consider the caravan option these days. Until there are more aires at least. Cheers, happy travels, Jay

Congratulations on the house sale. I am glad it has all worked out well for you. We are also thinking of touring Ireland, so fingers crossed we might finally meet you 😀

We are on our way home from a tour around Greece, you guys have been an inspiration for us.

Thanks Gilda – hope Greece was as enjoyable as when we were there, we need to hear back one day. Yep – fingers crossed we meet on the Atlantic Way! Cheers, happy travels, Jay

Hello Julie and Jay, this is heartwarming and congratulations to you on the sale of your house. I’ve just finished OurTourDownloaded, which I thoroughly enjoyed so it’s great to see the house where all the ideas for it came together! I’m in awe at how swiftly you’ve invested the money. VWRL?! I’m not invested, but am reading the books you suggest. I will be making the decision in the near future on whether to rent out my property or to sell and invest it in possibly Vanguard’s LifeStrategy 60 or 80%. I just wanted to say thank you, your blogs are interesting and informative and inspirational. Wishing you a very happy birthday!

From Louise x

Thanks Louise 👍. We’re using VWRL at the moment, but we’ve also used Lifestrategy 80 in the past. We’re comfortable with the increased volatility of VWRL as (a) we have other sources of income (b) we can use cash and premium bonds for short to medium term needs (c) we can reduce our spending if necessary and (d) we’re still living well within our means. We’ve done fairly well with property in the past but having been landlords for the best part of 15 years we’re a tad tired of the cost/legalities/ongoing issues etc. Best of luck with the decision. Cheers,Jay

Thank you very much for your reply and valuable info. You’ve got it covered from all angles. I must be on the right lines as I too will hold rainy day funds in premium bonds and gradually get the bulk into the ISA fund for the long term if I sell. I’m attached to the house and it is difficult to think about letting it go. As you say lots of changes with rentals which all needs weighing up. All the best and enjoy the summer.

Really interesting to hear about your ‘van/car combo’ idea! Agree that it can be a pain to use the motorhome for day trips, shopping etc. We’ve done this a few times on this trip to Ireland as the distances from sites to ‘attractions’ was sometimes a bit too far even for our e-bikes! Parking a 7.5m box in small towns and villages can also be challenging too.

Thoroughly recommend the WAW. Some fantastic places to see although places like the Ring of Kerry can get crowded with tour buses etc. We’ve been here 8 weeks and home next before the school hols. start. Prices are certainly going up here, at least as much as the UK and possibly a bit more although diesel is a wee bit cheaper!

Thanks again for taking the trouble to detail your trips. You are a real inspiration to us.

Best wishes, Andy and Helen

Hi

Just a quick one from Turkiye. I spent 3 months last year traveling around England, Scotland,Wales, NI and then the Wild Atlantic Way as far as Galway before heading back via Dublin and Belfast. WAW is stunning but don’t ignore the coastal route from Belfast before joining WAW. It was an enjoyable experience and prepared me for my current around Europe and Turkiye trip of 4 months so far.

If I can find the time I’ll complete the WAW from Galway onwards. Sorry to hear about your tribulations as landlords as it’s not for everyone. I persevere and to date have had few problems . 🤞

Oh dear ! Surely all this driving a motorhome plus car is terrible for the environment ? I think it is bad enough that we are all driving around for pleasure in large diesel vehicles without adding extra cars as well. We try not to drive at all once we have arrived on site, using public transport if it is too far to cycle or walk. My husband says one of the recent Club magazines has an article on this very subject.

It’s a good point Karen.

To be fair we’ve driven the motorhome all of 30 mins from home then it’s being parked stationery for two weeks, off-grid.

We’re using the car for journeys around the local area which are too far for us to hike, run or cycle (public transport around here is dire).

I’ve not done the carbon calculation but my guess is this is far cleaner than our recent tour of Wales, done exclusively in the van (and massively cleaner than our cross-continent tours).

Cheers, Jay

Glad you both feel more relaxed now the house sale has completed. Enjoy the sunny weather while it lasts. With the current news full of the Uk going into recession it sounds like I will be selling my rental property at the wrong time.

I am still waiting for the tenancy to end so I can claim possession on my property. I cannot do anything until then and there is a lack of properties for sale in the area so no idea if it will sell quickly or languish. If I can just break even on the sale then I will be happy and invest the proceeds. It is hard to know with property, it was a good investment at the time (10 yrs ago) but the changes to landlord rules now make it too much for me now as a non professional landlord. I am hoping that the tenant does not become difficult but in the current climate I am not too sure. The cost of living and the lack of alternative rentals in the area may prove to be a hinderance as the tenant is not in a position to buy.

A few stressful months(year) ahead for me i guess.

Look forward to reading about your trip to Ireland. Take care and enjoy life.