Miracles do Happen. The Wonder of Passive Income

Working 9 – 5. As far as I knew this was the ONLY way there was.

This is how your life is supposed to work:

- You go to school.

- You go to university.

- You get a job.

- You buy a house.

- You start paying into a private pension.

- You buy gradually bigger houses, and nicer cars.

- You work for 30 or 40 years.

- You retire between 55 and 67, living from a combination of your private and state pensions.

- In retirement, you have to learn to live off a much smaller income than you had in your working years.

And this is how we’ve done it:

- We went to school.

- I went to university

- We got jobs.

- Ju bought a flat, I bought a bungalow.

- We started paying into private pensions.

- We sold Ju’s flat and bought a bigger house, renting out the bungalow when we couldn’t sell it. We bought second hand cars. Ju got a company car.

- We worked for about 20 years.

- BOOM, TROUBLE IN PARADISE. I had a work-related breakdown and couldn’t work, I was messed up, I could hardly speak. Fortunately by this time the house mortgage was paid off. We quit work and spent 2 years travelling, renting out the house and bungalow.

- We figured out we could reduce our costs, at the same time get more income coming in without working.

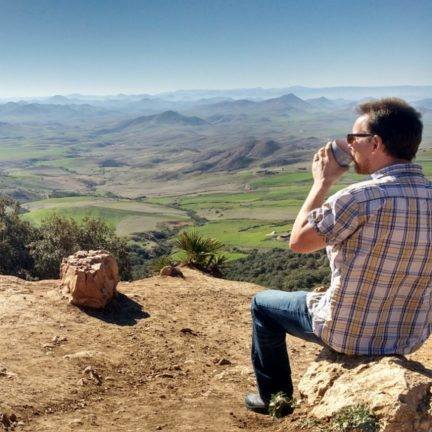

- We quit work at 43 and, if we choose, never have to work again. You might consider me sat here in France on a Monday afternoon typing this to be ‘work’, but I’m enjoying it so much my cuppa just went cold, so I’m not considering it to be work.

- When we get to 55, our ‘retirement’ income will increase as private pensions start to kick in.

- When we hit 67, our income will again increase.

We made it. the North Cape in the Norwegian Arctic. Yeah baby!

Is this really possible?

It sounds unreal, but we’re living proof that it’s possible. We’ve been living off passive income for over a year, during which we spent 10 weeks in one of the most expensive countries on Earth (Norway), and our plan is showing no signs of failure any time soon.

My exposure to how life should be was following the first set of steps, until I hit 39 years old. Then we set our own course. Neither of us knew anyone who’s done the second set of steps, who’s quit work a decade or two early with a reliable income coming in without working. Neither of us knew anything about passive income, but now we do, and it feels like a miracle. But truly rich folks, those who don’t work for a living (I’ve never seen Benefit Street, but I’m talking about investors rather than folks supported by the state) have been doing this for ever.

Please note: you don’t need to do the Full Monty to benefit from passive income. You don’t have to quit work like us layabouts. You can continue to work, while gradually building up passive income streams which in turn gradually reduce your reliance on the monthly pay cheque. In turn this gradually reduces stress levels as your own personal safety net gets strung up below you.

Where does the money come from?

So, this is where where our income currently comes from:

So, this is where where our income currently comes from:

- At the moment, the majority of our income is from rental properties. We have management agents who deal with day to day issues, finding and veting tenants, receiving the rent, arranging inspections, repairs, gas certificates, almost everything. This costs us approx 10% of the rental income, and means we do almost zero work in this area.

- We hold a portfolio of shares, almost all of them are Vanguard ETFs. I’ll write about these another time, but they’re a way of being invested in a large spread of companies around the world, receiving dividends. Also, if history is anything to go by, in the long term (10 years) the value of the shares will also increase. We do almost zero work to receive dividend income, it just appears every 3 months in our ISA accounts.

- Two of our properties have solar panels on the roof. The government pays us for the energy they generate, via our utility company, something called the ‘Feed in Tariff’ (this has since been reduced down to a much smaller payment). The sun shines, even in the UK. Ju takes monthly meter readings via a web portal and inputs them to the utility company website. The money appears in our bank some weeks later. Again, we do almost no work to receive this money.

- Ju has a number of customers and a small team recruited through Utility Warehouse (UW), a FTSE 250 network marketing company operating a model a bit like Avon. The company is a discount club offering its members ways to save on their household bills, and each month Ju’s paid a small percentage of her customers bills. We do nothing to earn this, although her business isn’t growing as well as it could because we’re out of the UK too much to introduce more people to it at the moment!

- This blog generates income on a daily basis, through folks clicking on adverts or buying anything from Amazon via the links on the site. We’ve also started to generate sponsorship income, which is a one-off, like the ad we have for Safeguard on the right. This income is partially passive: we receive it whether we update the blog with new posts or not, but the income is higher when we’re actively adding new material or actively looking for sponsors.

- We have a number of eBooks published on Amazon which generate a small income without us doing a stroke of work. We could write more books to increase this income stream.

The reality check: this isn’t get rich quick

To get to the point we’re at, a serious amount of effort was involved. Let me not try and kid you. We read about folks somehow managing to get a portfolio of millions of pounds worth of property starting with a credit card, or someone hitting on a fantastic idea with a website or YouTube channel which created a huge income with very little work. This didn’t happen to us. For us, we had to work hard, and I suspect for most people the same is true. That doesn’t make it any less possible.

Living in one of our rental properties while we redeveloped it wasn’t our greatest idea!

Reality check 1: A lot of work is involved! You might have spotted the fact that to get this income, we had to do a load of work in the first place. We had to earn money to buy properties, shares and solar panels. We spent years building this blog before it generated any appreciable income. Ju spent many hours recruiting UW customers. That’s the reality of it: you do a serious amount of work up front, but then it’s pay back time: the money flows back in for ever.

Reality check 2: You need a LOT OF MONEY invested to generate enough money to live off. As a very (VERY, VERY) rough rule of thumb, you’ll need 25 times the amount invested as you need to live off. So if you need £20,000 a year, you’ll need 25 x 20,000 = £500,000. Ouch. The good news is, while you have a job covering your living costs, the passive income you get can be re-invested, which in turn will generate more passive income. This happened to us, the opposite of spiralling debt: spiralling wealth, and if felt just incredible.

Reality check 3: you need to change your mindset. If you want to switch from ‘active’ income (working a job) to ‘passive’ income (money flows in while you sit on the beach). You’re going to have to switch your thinking. You’re going to have to dedicate time and effort to understanding investing. You’re going to have to get a handle on risk (good news here: whether you invest or not, there is ALWAYS RISK, you cannot avoid risk). You’re going to have to switch mindset, from working for money, to having money work for you.

If there is one single book I can recommend to read off the back of this post, it’s Rich Dad Poor Dad by Robert T Kiyosaki. It helped me get a handle on the fact it is possible to get ‘rich’ without being some kind of evil money-grabbing devil. It helped me understand that anything we owned which didn’t generate an income for us was costing us money, and in turn increasing our stress levels as we worked to keep it. Reading this book was a turning point for getting us free.

Cheers, Jay

Brilliant! I got my mind right now boss (Cool hand Luke). A willing partner also helps ease the transition. Yes, there is sometimes alot to keep on top of, but then, you used to spend 40-60 hours a week doing tasks you would rather not…normally for someone else. The future’s bright…just don’t snuff it! ;-) :-) :-) Kindest…Wayne.

Hi there you three – Hilma the Hymer signing in after a long break :-)

We have been following your travels and great to see you are off to warmer climes. After taking ownership of our Hilma in March we’ve managed six trips away (all UK based) so we are finding our motorhoming legs. Next year the North Coast 500 and a first foray into France (eeek).

Anyway Bon Voyage – will kep popping in now and then

Ian & Janette

PS – still working!! :-(

We are now in a position to retire at age 51, just waiting for the kids to fledge! Satisfied with short hops in the camper for now.

You are right that although I am still working full time it is so much more enjoyable knowing that you could walk out tomorrow if you are not happy with what you are asked to do. It empowers you as well to be able to express your opinion on the right path without having to toe the company line (in a constructive way)

Hi Guys…..on my own similar journey……..what proportion (%) of your income comes from each of the various streams you define there?

Hi Colin. We’re very roughly 10% blog income, 10% Solar, 10% Shares and the rest rental income plus the other bits and bobs. When we hit 55 we’ll be able to diversity more as pension income starts up. Cheers, keep pushing on, Jay

Thanks Jay. I’m somewhat fortunate that I’m already 55…….so could access pensions if needed. At the moment I’m choosing to leave them invested (one is a final salary from 20 years spent working for a major blue chip, and the other is a SIPP………invested in Vanguard ETF’s and index funds!) I’ve also got earnings from a few websites and also ebooks on Amazon.

I agree that having several income streams is the way to go. Have you looked at P2P lending – such as lendingcrowd or lend invest?…….they seem like a good way to invest in both businesses and property…..and its easy to spread the risk within each platform. I’m experimenting with both – small amounts to begin with……………

Hi Colin, we have a number of P2P investments. We also take advance of SEIS, Seed Enterprise Investment Scheme (SEIS) which offers tax efficient benefits to investors in return for investment in small and early stage startup businesses in the UK. Might be worth comsidering as part of your P2P portfolio.

Brilliant read as always and especially because it links in with our lifestyle. Funny how we’ve both had similar patterns in life!

You don’t have kids then?

I don’t say this to be rude or disrespectful in any way. I’m on the same journey, but it’s hard with kids. That’s the point I’m making!

We don’t have kids, nope, I bow down to anyone who does and is trying to do this! You might want to look at The Escape Artist, he quit work at 43 and has 3 children. Cheers, Jay