Are we mad?

This blog post was originally written in November 2014 for our sister website – The Money Muppet. We set that site up in January 2014 as we embarked on our journey to financial freedom. The Money Muppet site no loner exists, so we’ve incorporated our financial journey into our travel blog.

This blog post was originally written in November 2014 for our sister website – The Money Muppet. We set that site up in January 2014 as we embarked on our journey to financial freedom. The Money Muppet site no loner exists, so we’ve incorporated our financial journey into our travel blog.

I had a long chat with a good friend the other day. He lives in Germany so we don’t see each other often, and once we’d caught up on how family and work were going, we talked about our plan for financial freedom. It’s fair to say he wasn’t on board with he idea, and I can understand why. Basically I was telling him we were planning on giving up (again, we’ve done this before) high-income, relatively secure careers, and taking a path of far lower income. Are we doing the right thing and why would we do this?

It’s a good question, and one worth pondering. We’re both 42. We didn’t get to where we are work-wise without significant investment in ourselves. I’ve a degree in Physics, which cost my parents and myself (through student loans) a significant sum. Ju was a chartered marketeer, which cost her much of her free time for a good few years. We’ve both pushed ourselves (sometimes too far) as well, taking more and more responsibility, taking on jobs which basically scared us, before gradually getting used to them and pushing ourselves again. I’m currently contracting, which involves pushing ourselves (dealing with accounts, negotiating rates etc) as well as risk (if I get sick, I earn nothing, and contracts are relatively short term – usually 3 to 6 months at a time).

We’re not even at the peak of our earning potential. My work managing IT projects pays well, and as a contractor I know of more senior freelancers making 30 or 40% more than me.

Many people would give their all to be in the same income position as us. I have to go back a step here again though. We didn’t get here entirely by chance. It was bloody hard work; we had to stress ourselves time and again to get here. If a job came up which made one of us feel sick at the thought of doing it, we went for it anyway. I guess what I’m trying to say is that I feel we’ve earned the right to make a call on what we do from this point onwards.

So, our plan is to halt this particular career path as soon as our passive income exceeds our yearly expenses; basically once we’re financially free. The question remains: are we nuts? Given the fact neither of us want a big house/car/etc, with the rate we’re saving we could make ourselves rich.

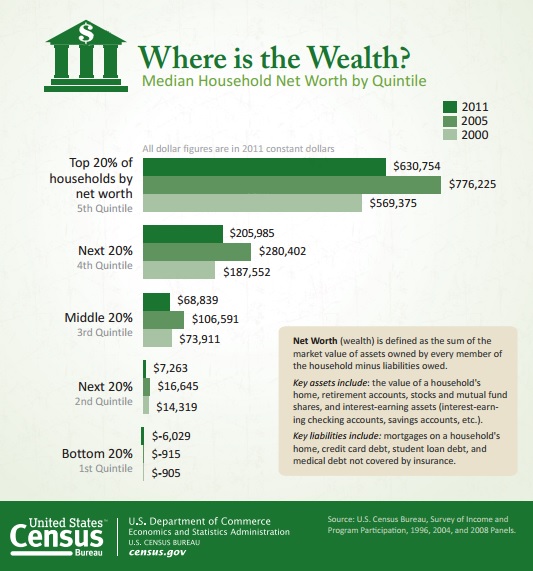

But hang on a minute, even by the standards of the ‘Western’ world we’re already rich. Have a look at the infographic below, showing the net worth of US citizens. In comparison with those living in the US, one of the richest nations on Earth we already sit in the top 20% of people (including our pension pots). Check out the bottom 20% by the way, a fifth of US citizens have an average net worth of $-6029; they were worth less in 2011 than when they were born – that’s over 60 million people. What the blazes is going on?

The question still stands though, perhaps we are mad heading down the the path we’re heading. We’ll keep pondering it as we go, but my feeling at the moment is that this decision, swap high-income life for high-freedom life, is probably one of the most sane decisions we’ll ever make.

Cheers, Jason

Previous: Scary Stock Market Investing Simplified

Next: The Three Truths of Financial Freedom

Leave a Reply

Want to join the discussion?Feel free to contribute!