Win a Copy of the Meaningful Money Handbook (COMP NOW CLOSED)

COMPETITION NOW CLOSED – thanks for all entries, the winners have been notified, thanks, Jay and Ju

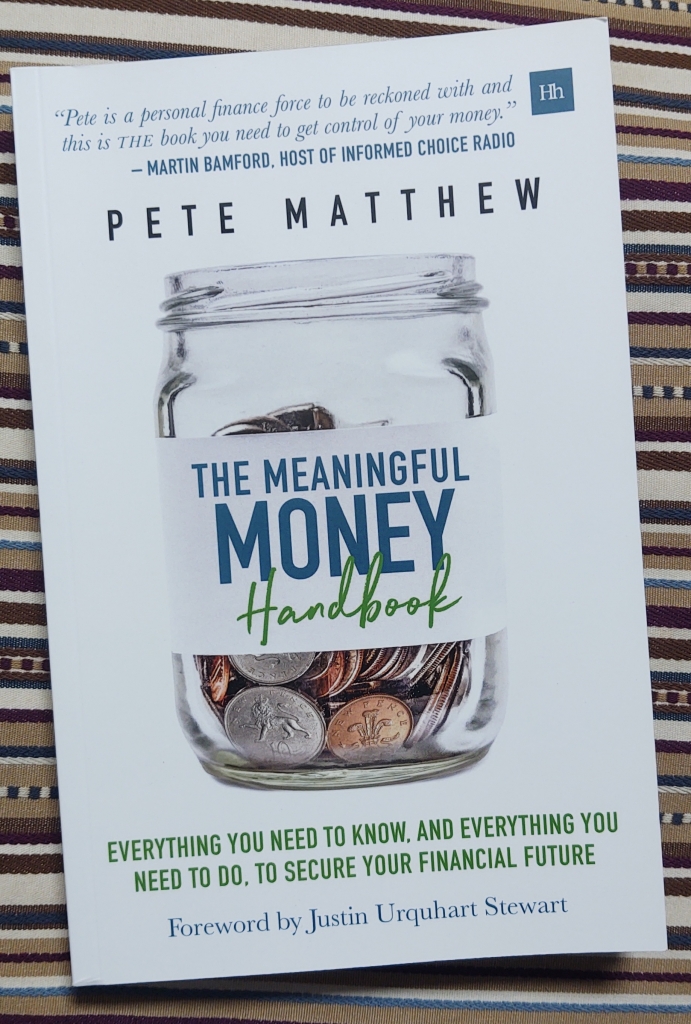

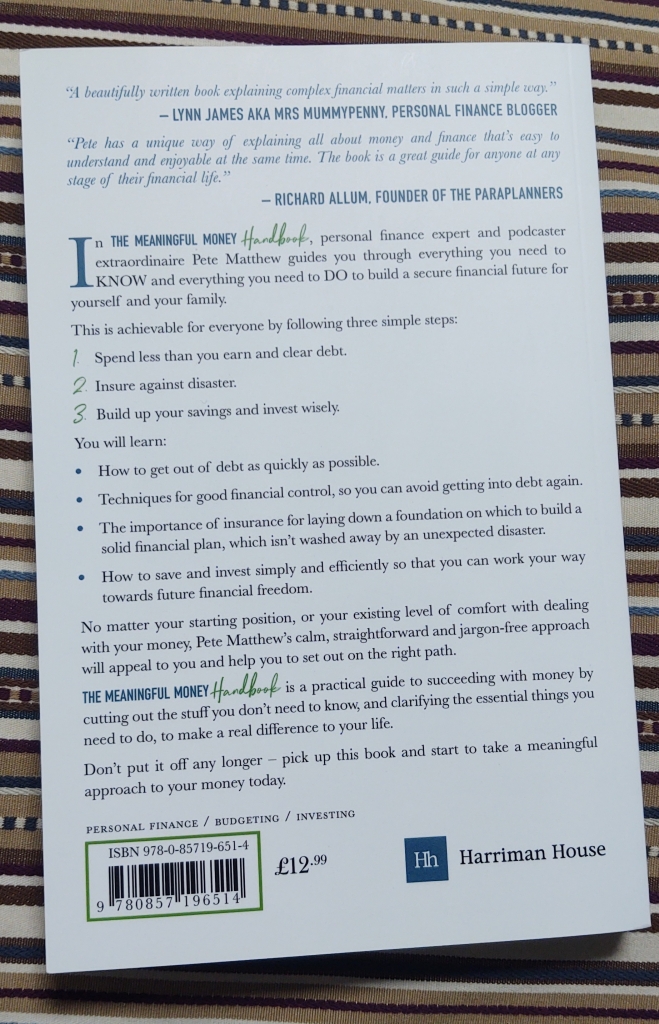

Whether your dream is to tour Europe in a motorhome, to get financially-free and retire early or to bring yourself or your family into a secure position, money is critically important to each of us. With thanks to personal finance guru Pete Matthews, we have something which will give a boost to your financial planning: two copies of his highly-rated book to give away: The Meaningful Money Handbook.

Why this book?

When Julie and I went all-out to attain financial freedom, we quickly came across Pete’s website meaningfulmoney.tv, and found his videos explaining the core concepts of finance to be friendly, fun and easy to understand. Pete is a finance pro. He’s a chartered financial planner and runs his own wealth management company down in sunny Penzance, so he really knows his onions! Not only that, he’s confident enough to cut through the financial jargon which some banks, pension managers and others seem to hide behind (yes Equitable Life, I’m talking about you, good riddance!!! #*!$%#!*).

Ahem, where was I? Ah yes, since we first started following him, Pete branched out into podcasts and has now summarised all of his key content into a book: The Meaningful Money Handbook. The book is short enough to be easily manageable, covers all the critical topics and sticks to plain old English, so anyone will be able to grasp what he’s saying. His style is engaging, the exact opposite to the ‘dentist appointment’ dread I’ve come to expect when dealing with financial companies.

Did we do what Pete says?

Julie and I are outliers in the personal finance world, having effectively retired aged 43 (this free eBook briefly explains how we did it). But yes, although we’re towards the aggressive end of the spectrum, we followed Pete’s three step process: 1. spend less than you earn and clear debt, 2. insure against disaster and 3. build up your savings and invest wisely. We didn’t win the lottery or come up with some brilliant business idea or invention. We earned, saved and invested, just like Pete explains in his book. No one can predict the future, so it still remains to be seen whether we’ve ‘invested wisely’, but we’ve been financially-free for over four years now and it’s going OK so far!

How to get your copy.

The book is available as a paperback from Amazon (available here), an audio book (available here) and an eBook (available here). As mentioned above, we also have two copies to give away, thanks to Pete. To be in with a chance of winning, just add a comment below saying why you think you will find the book useful. Use a real email address and at 3pm on 21 June we’ll select two comments at random and the winners via email for your postage address to send the paperback to.

A parting shot. Getting a handle on your finances is, from our experience, hard to get started on. Once you’re up and running though (which this book will seriously help with), then it’s like pushing a rolling stone or going for a run: much easier once you’re moving!

Thanks and good luck! Jay

We are planning to be debt free and financially independent to early retire and travel the world in our motorhome MrJingles. Your blogs and book recommendations have been a massive help towards this and you both inspire us. Were basically jealous haha but intend to be in a similar position in life as you two.

Hello Ju & Jay, Thank you for the opportunity to win this free copy of Peter’s Meaningful Money book. We are a family with two girls. As you can imagine it is a challenge at all times to think about today let alone tomorrow and then to put some on the side invested for our future. Like everyone you hope that you grow your earnings over your career to give your children the courage to aspire to be better than us, to be caring, courageous, confident. That is what we wish, if we achieve these dreams we then can focus on our dreams. Kind regards, Pedro & Vivianne

I’d love to win a copy as we’ve made a good start and paid our debt off, now we need a bit of help with the next steps and this sounds like it may be perfect!

We love to have a read, since selling up we are not sure what our next step is financially. Our plan for now is working the summers, to find the winters and still save. Would be nice for some ideas and guidance.

Hi, looking to sort out my disastrous financial situation. Young family, mounting debt, needs sorting and hopefully this book would help us out!

I’ve had this book sat in my ‘Wish List’ for a while now, but as I’m trying to direct every spare penny towards debt right now, I haven’t been able to buy it. I’ve decided I really need to invest more time into educating myself on the best approach once debts are cleared off.

Entering my 30s as a divorcee was not in my future planning (!) I see this new stage of my life as an opportunity to learn about how I can look after myself financially for the future. This book comes highly recommended and I’m hoping this will give me the kick start I need.

Like listening to Pete’s podcasts and would love this book. I’m learning all the time and people like you give the inspiration that it could be possible 🥳 good luck

I have followed Pete myself for around half a year and with his guidance I feel more secure with my finances. Now my other half is also wanting to learn more about the topic and so i can think of a no more aptly time book for her!

Hey! I’d love to read this. I just turned 30 and have big dreams for the future – if only I was brave enough to take the leap and start investing! Up until just a few weeks ago I knew nothing about money, thinking that I was a winner because I kept my hard earned savings in a 1.1% Monzo account. My partner keep saying he wants to retire early. I never thought there was even a slight chance this could happen, but now I see that, with the right guidance, I could make it possible for both of us. Thank you for the chance to win a copy of Pete’s book. I hope I’ll be lucky enough – if not, I’ll definitely buy one!

Aged 50, I was made redundent from an airline. A few months later, thanks to Cov19 the airline industry imploded. Its estimated 90,000 pilots worldwide are seeking employment. Not me, I sold my house and am buying a motorhome to live in full time and travel a little more slowly than I used to. I’m certain, with a little financial education, I can remain financially independent. Ironically, there are alot of financial professionals who would like to take my money to tell me what Pete will teach me in this book, thereby reducing my capital and chances of remaining financially independent.

To live in hope there would be tips to help me retire early too! 🤞

Retirement is peaking just over the horizon and having worked all our lives we want to make the most of our time afterwards.

Jason and Julie have been a mine of information for us since planning and starting our motorhoming early retirement 3 years ago, along with a few of the other bloggers. We have always had a deep seated concern about IFA’s…really need one now, given the current interest rate situation. Someone recommended by you 2 is definitely worth a look at, if he can cut through all the jargon and put things in plain English!

Been working towards early retirement for a while now. Have drastically cut our out goings, invested over a number of different risk areas (which means despite this virus should be able to retire early, even if have to do some part time work in the future) and started to plan what we want to see and do while we can. Lockdown has shown how little we need in life and how little we need to spend. We will not be going back to buying “things” we do not need. This virus has shown me that I need to get out of the corporate world and enjoy life… but I know you understand that.

Have just lost my job at 60. Got some savings but this might be the road map I need. We non of is know how long we have left to live & as you age that uncertainty grows. The moves at the same speed for all of us irrespective of our assets. We should all try to fill what the we have well. Slaving away at a job you get little satisfaction from other than a wage, is squandering your most precious thing. Having s plan to escape & do what will make you happy should be top of the list for many people.

Made redundant at 50 and am trying to make early retirement work. Found Pete’s podcasts and am working my way through them.

We’d love a copy to make notes in to compliment the lessons learnt on Pete’s podcast. Thanks!

Hi Ju & Jay,

Avidly following your adventures during the last few years helped me persevere on my FIRE journey. My goal is to quit work as soon as I (think) I have enough, buy a van, and finally go enjoy everything our world has to offer.

The hardest part? It’s when I read your French / Spain / Morocco / Sweden posts and have to resist the urge to go and buy the van strait away!

A copy of Pete’s book would be perfect to help me improve the way I manage my finances and maybe bring me closer to my goal.

Hi Jay and Ju,

We’re the same when it comes to speaking with so-called financial experts!

Pete Mathew sounds more like our kind of guy; we’ll certainly be checking out his podcasts.

Please put our name in the hat for the prize-draw! Thank you.

Hi guys,

My financial situation was turned upside down a couple of years ago. Hopefully a copy of this would help enable me to get back to some financial stability. Thanks

Hi Guys, would like the opportunity to win this book please. We sold up 18 months ago, we are in our 40s, with house money in savings and not sure what to do next with it? We travelled around Spain for the winter after working as wardens in the summer. Now we’re stuck in Limbo due to COVID, we would like our money to work for us better so we can sustain this way of life for a long time coming.

Love your blogs and gutted to have missed you in Nerja! Stay safe x

Would love to win this. Trying to find ways to clear debts and have the campervan of our dreams, so could really do with the help. Good luck everyone.

This book looks very interesting – even if you can manage to get a savings pot together, it’s knowing how to get even a small return that is the eternal mystery for me. Hoping that this book would shed some light on the matter….

I would love to win a copy of this to give to our two adult daughters. I am 54 and so wish I had been a bit more forward planning when I was in my late 20’s. would love to be retiring now and taking off in our motorhome! Would like my girls to gain the awareness earlier than me. Thank you for your lovely blog!

Hi Jay & Ju. I guess you already know our situation and why we’d love a copy of this book! It doesn’t matter how many times I shape and re-shape my spreadsheet, the money situation looks very tight. Not expecting any silver bullets, but a book full of advice on how to avoid financial bear traps and help us best eke out what we have, would be just what we need.

Hi, thanks for the opportunity to win a copy of the book, it is always great to read how ‘real’ people manage their finances and to continue to educate yourself. We both left corporate life 5 years ago so we could travel more in our camper. We are about half way To full retirement at the moment, having funds to take long trips and work in between. It would be great to get to full retirement , especially as I had the big 50 this year. Although it didn’t really happen as the party was cancelled due to Covid. Thank goodness we already follow some of these principles and always have 6 months living expenses saved, as we due to Covid our main source of income completely dried up, a holiday let and we didn’t qualify for any help from the government. But, due to our planning we have weathered the storm and have everything crossed for July 4th as a reopening day. Plus to celebrate we have booked a little local campsite near where we live as I know they will have been struggling as well.

Hopefully we can all get away for longer trips soon in our vans, or to a lovely pet friendly holiday cottage in the Cotswolds!! with some financial education reading to Keep us company.

We took the plunge 2 yrs ago aged 58 -retired and purchased a motorhome with the plan to travel as much as we could and for as long as our savings lasted. COVID has interrupted said plan but only temporarily.

Having seen info on this book we can now envisage our adventure extending to a longer period if we actually invested rather than just ploughed through our savings. So would love opportunity to win the book.

Hi Ju & Jay,

I really enjoy reading your weekly updates.

I Have been listening/reading Pete Matthew’s podcasts/videos for a few years and consumed his full back catalogue!

Quite simply, Pete gives freely all the information you will ever Need.

Hi Both,

Would like to win the book and share the wisdom with our family

I would like this book as I really enjoy Pete’s content and would enjoy reading this book in between my shifts working for the NHS at this busy time!

I heard about this book from my colleagues. They responded very positively. I think for everyone it is very important to find financial freedom.