Seeking the Cash Leaks: How We Track Our Spending

This blog post was originally written for a sister website called The Matrix Experiment. We set up the site in January 2017 to pass on financial hints and tips we’d learned as we became financially free. The Matrix Experiment site no longer exists, so we’ve incorporated this financial information here.

Even since hitting financial independence almost two years ago, we still track every penny we spend. This post explains why, and how we do it.

Even since hitting financial independence almost two years ago, we still track every penny we spend. This post explains why, and how we do it.

Who This Post is For

This post is or everyone, where ever you are on your journey to financial freedom. Trying to gain financial freedom without knowing where your money goes is a bit like going on a diet without weighing yourself. We’re not skint. We’re not living in poverty. Although we live on a relatively low income of about £15k a year, we don’t really HAVE to track every single penny in order to stay solvent. If things got tight, we COULD decrease our spending – we know this because by tracking our spending we can see areas where we could spend less. So, why do we choose to continue to track our spend? It enables us to keep control over our money, and not let our finances control us.

Straight to the Guts of It

OK, let’s not muck about. We got financially free at 43 by (a) earning as much as we could and (b) avoiding spending as much as we could. This post is about the second half of that equation – by cutting out life costs we both created more capital to invest, and reduced the amount we needed invested to support us.

In order to avoid unnecessary spending, we found we needed to know:

- What we were spending our money on

- Which spending was essential

- Which spending we could cut out without battering our enjoyment of life

How many of us know this I wonder, in any detail? Ju’s been tracking our general spending for about ten years, and at the penny level for about five years. Note: Ju does the spend tracking, not me, as I just don’t have the patience for it. It doesn’t take a huge amount of time or skill, but it does take some serious commitment. It started at the penny level because we were going travelling with a pot of money to spend on the trip, once it was gone we would have to return home. Now it’s an ingrained habit, and it gives us a great view of where all our money goes and how our spending compares to our ‘budget’ of £15k a year.

How many of us know this I wonder, in any detail? Ju’s been tracking our general spending for about ten years, and at the penny level for about five years. Note: Ju does the spend tracking, not me, as I just don’t have the patience for it. It doesn’t take a huge amount of time or skill, but it does take some serious commitment. It started at the penny level because we were going travelling with a pot of money to spend on the trip, once it was gone we would have to return home. Now it’s an ingrained habit, and it gives us a great view of where all our money goes and how our spending compares to our ‘budget’ of £15k a year.

This is the process she uses:

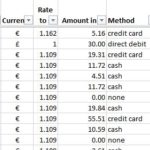

- She carries a small paper diary with her and whenever we spend anything while out and about, she makes a short note of what it was, how much it cost and the payment method (Ju used to have a spends book but found that she always had her diary anyway so combined the two).

- She transfers this info to an Excel spreadsheet every few days.

- At the start of the month she also records direct debits that she knows will be going out on the spreadsheet.

- When the bank statement comes through she does a quick check to make sure nothing has been missed.

- Every line on the spreadsheet is categorised by both Spending Group (diesel, eating out, house insurance etc) and by Spending Method (cash, PayPal, debit card, credit card etc)

Note: If we are going out for a night, we’ll take an amount of cash with us and only use this while out. The following morning we’ll add up what is left so we know what we spent – otherwise you get strange looks if you get your diary out after every round in the pub!

She then does weekly, monthly and yearly ‘reports’ from the data – quick and easy stuff in Excel – so we know where the wonga went. And that’s it.

She then does weekly, monthly and yearly ‘reports’ from the data – quick and easy stuff in Excel – so we know where the wonga went. And that’s it.

Here’s a blank copy of the spreadsheet we use, which might give you some ideas for setting up your own.

Blank Spend Tracker Spreadsheet

What We Did With the Spending Data

Sounds like living the life of a monk, I know, but it really isn’t. Once we’d eyeballed a particular type of spend, we made a decision on it, and then didn’t have to make that decision again. It wasn’t anything like as painful as you might imagine.

The decision each time is whether to:

- Try and reduce that line item – get a better deal on insurance at renewal, switch energy supplier, change the TV/mobile package, not buy that item so often, etc.

- Eliminate that item – in many cases we decided freedom was worth more than the item, or that we just didn’t use it and were honking money down the drain.

- Keep spending on that item – not just the essential stuff – mortgage, utilities, certain types of insurance and so on – but also non-essential stuff like the fact we keep a rented storage location for our motorhome even though we’re often away touring.

If You Don’t Like or Have Excel

If you’re not a spreadsheet fan, but have a smartphone, there are tons of apps available – like these. We’ve kept our tracking manual mainly, I suspect, as we started it before these apps were available. It does also means we can run more customised reports on specific areas of our spending to get a more detailed understanding of what’s happening, which can’t be a bad thing.

It’s Not Rocket Science, But It Can Take Courage

We’re not particularly brave souls, but we do recognise that this kind of spend tracking can take a wee bit of courage. Especially if you’re a couple, there’s a very good chance you’ll experience a bit of, ah, friction over who’s spending what. We did away with separate bank accounts years ago, and have pooled all of our resources, so I guess we slowly built up to this level of ‘shining of glaring lights’ on dark spending secrets. Like any part of a relationship, talking about this stuff candidly seems to be the way to tackle it.

Tracking Immediately Changed Our Behaviour

The act of tracking spending had an immediate affect on us. Our saving started to go up almost as soon as we started doing it. Why? Simply this:

Tracking spending makes you THINK about spending.

As we considered each item we started to eye them in a slightly different way. Each time we found ourselves asking:

Would we rather have this THING, or would we rather have OUR FREEDOM?

And Finally, Some Stuff We Saved Money On

From memory, here are some of the things we cut out or cut down on to save money. These are here just as examples – obviously your own situation will determine what works for you. The items themselves aren’t hugely relevant, but it’s the type of thinking which you start doing when you track spending which is important. Over the years as we really got into it, we gradually got more and more aggressive on avoided costs, so some of the bigger examples below came later on in the process of reducing spending.

- We sold the hot tub

- We reduced our TV package then got rid of it completely

- We shifted from two smart phones to one, and changed to PAYG

- We changed supermarkets to Lidl or if shopping elsewhere we buy the own brand or ‘value’ range

- We installed LED lights when we refurbed a house – saved electricity cost

- We stopped buying magazines

- We stopped buying breakfast or lunch at work and took our own

- We reduced eating of takeaways (which was good for our health too)

- We bought shears and cut Charlie, our dog’s, fur ourselves

- Ju cuts Jay’s hair and only visits the hairdressers herself every six months or so

- We went from having two cars, a motorhome and a motorbike to just a motorhome and one car

- We agreed with adult friends to stop buying each other birthday and Christmas presents (much to their relief)

- We agreed with adult family members who we spend Christmas with to only spend £1 on each other

- We buy most of our clothes from charity shops

- We stopped buying random stuff on eBay while a bit drunk

- We downsized from a 3 bed detached (which we still own) to a 2 bed semi (rented) to a one bed area of our house (which we own)

- We opted to self-insure the contents of the room at home – since we’ve sold most everything

- We opted to self-insure Charlie the dog (although his costs are starting to rise, so that may end up costing us, we’ll see)

Cheers, Jay