From Now On, I’m Thinking Like a Rich Man

This blog post about thinking like a rich man was originally written on 10 February 2014 for our sister website – The Money Muppet. We set that site up in January 2014 as we embarked on our journey to financial freedom. The Money Muppet site no loner exists, so we’ve incorporated our financial journey into our travel blog.

One great advantage of not having a TV: I’ve a lot of spare time on my hands after work. As soon as one of us gets a permanent work contract, which will give us access to the mortgage market again, a do-er upper will be found and this free time will be sweetly gone as I’ll be up to my neck in tiles and plaster.

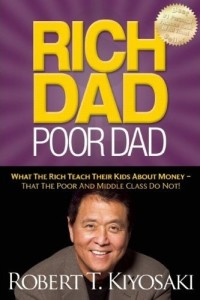

So I’m making the most of it. In record time yesterday and this evening, I read Robert Kiyosaki’s Rich Dad Poor Dad. A fabulous friend, who happens to be financially independent in his early 50s, told me about it as we got to know each other over bar-top tapas in San Sebastian (or pintxos as it’s known over there), washed down with a few glasses of €1 rioja.

It took me two years to get around to reading it, what a muppet.

Much like How to Win Friends and Influence People, it’s a book which slapped me in the face: you idiot, you should have read this when you were 20. If I had, and I’d got it, I’d now be rich, probably retired. If you’ve not read it, and you’re wondering where on Earth all your working life money’s gone, you might want to skip it. It’s a bit painful to learn these lessons so late in life. Kiyosaki basically splits us all up into two groups of people:

- Money Muppets

- The Rich

It’s some comfort we almost all fit into the first group. He doesn’t actually use the phrase ‘Money Muppets’, sadly, he calls us ‘the Poor and the Middle Class’. The one simple distinction he makes between the two groups:

- Us Muppets work for money

- The rich make money work for them

Put simply, we spend our money on stuff which doesn’t make us money. Big houses, new cars, label clothes, a hot tub, holidays in the Maldives, motorbikes, blah de blah, all that fancy stuff we get because, well, we can afford it, can’t we? The rich on the other hand plough their cash into smart investments, researching and buying into rental property, stocks, businesses, whatever works for them. Only when these are pumping cash back towards them do they use this passive income to buy their Porches and Michelin Star restuarant meals. They continue to invest of course, getting better and better at it, and richer and richer. They also pay far less tax than the average muppet too, all completely legally and legitimately.

I won’t reveal any more. On my long winding path away from financial illiteracy, this book feels like a good first step up, a solid foundation. I personally don’t want to be rich in the conventional sense. I’m not bothered about what I can buy with money, with one exception, I’ll use it to buy my freedom.

Cheers, Jay

Previous:The Risk of Inaction

Next: Our Basic Strategy to Retire at 50

Leave a Reply

Want to join the discussion?Feel free to contribute!