Our Second Full Year of Financial Freedom – The Numbers

We’ve just completed the second full year of our strange life experiment that’s called financial freedom. Why do we call it an experiment? Mainly because we’ve no idea if it will work. In theory we never have to work again, that’s not to say we won’t work again – there’s a difference between wanting to and having to. So, if we have our numbers right and there are many, many spreadsheets we’ve used to number crunch this, then we have more than enough to keep us going well to retirement when our private pensions will kick in and give us a pay rise.

We’ve just completed the second full year of our strange life experiment that’s called financial freedom. Why do we call it an experiment? Mainly because we’ve no idea if it will work. In theory we never have to work again, that’s not to say we won’t work again – there’s a difference between wanting to and having to. So, if we have our numbers right and there are many, many spreadsheets we’ve used to number crunch this, then we have more than enough to keep us going well to retirement when our private pensions will kick in and give us a pay rise.

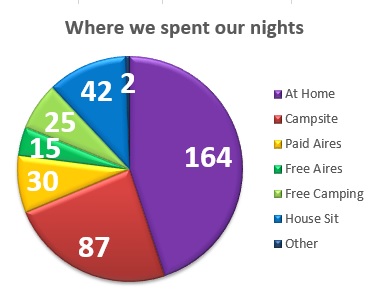

We’ve already published the costs for our last 8 month trip which began in November 2016 and saw us arrive back in the UK toward the end of July. We’ve been back home ever since enjoying being in one place and part of the local community again, something I’ve realised I miss when we are on the road. So, this post covers our crazy life experiment for the whole of 2017, not just our trip costs, as a sense check for us so we know we are on track, and we figured you might be interested too if you are thinking of doing something similar.

You can find out here how we did in our first full year of financial freedom

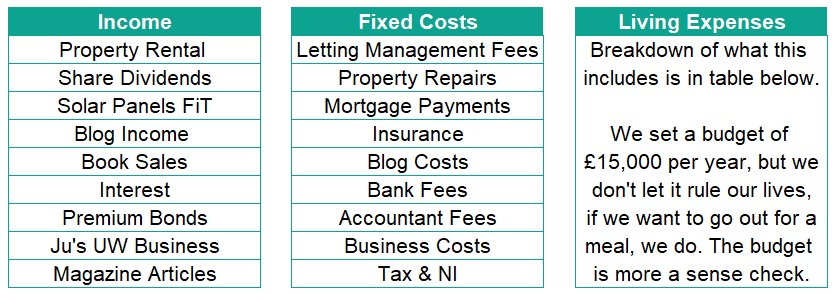

To give you an idea of how we manage our finances, here’s a bit of background information.

Tracking – I track all of our income and what we spend each and every day in my diary, which then gets put into a spreadsheet. The information is all there, but we don’t spend hours studying it. We’ll have a quick monthly check to ensure that we aren’t massively overspending. We don’t accrue/spread/weight the big annual costs, such as MOT and service of the van, across the year, so we know some months we’ll be up, others we’ll be down.

The spreadsheet is split into three tabs:

2017 Numbers

2017 Numbers

We know from previous years on the road that when we are touring we tend to keep within budget, however in 2017 we spent quite a lot of time at home, and we had no idea if that would work as cheap as life in a van.

When at home we live in a part of our home that we call The Cooler. It’s effectively a small out-building that we converted to give us a place for our stuff. We share the rest of the house with a tenant, which works out well as it means there is someone at home when we are away – to keep the house insurance company happy. This also means that the bills are shared, which helps keep our costs down. Our tenant gets a discount on the rent which covers the bills which are incurred if we are there or not, the costs you see below are for extra bills due to us being at home.

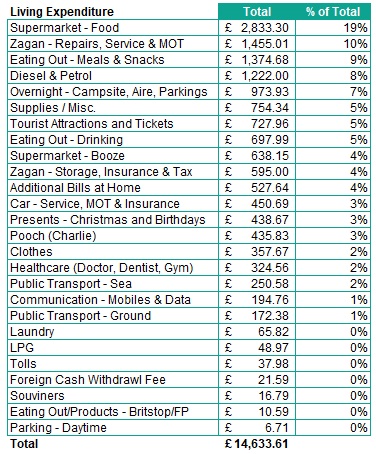

In terms of our ‘Living Expenses’, we came in under our £15,000 budget this year. Below you can see a full breakdown of our costs and how we allocate them, hopefully the categories are pretty self explanatory. Supplies / Misc is our catch all category – in here we put everything from haircuts, radio, books and plants to matches and cleaning stuff.

We’re pleased to see that we have managed to stay under budget while spending so much time at home, as this is further confirmation that our crazy experiment is working. While we were back in the UK Jay went back to work as a contractor for four months and the money he earned from doing that, after taxes etc, hasn’t been included in this because we haven’t touched it, we have invested it to help generate further income and give us a bigger safety net.

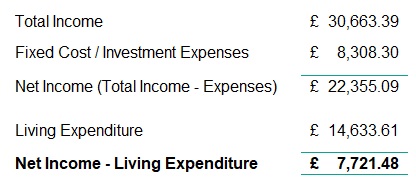

The really interesting thing for me though is our overall numbers. Taking our Fixed Costs from our Income you can see that we had £22,355 of Net Income in 2017.

Taking our Living Expenses away from our Net Income means that at the end of this year we had £7,721 left in the bank – you can probably guess what we are going to do with that! Yes we even living this lifestyle we are spending less than we earn and this year were able to invest 25% of our total income.

This crazy experiment thing seems to be working!

Ju x

Huge caveat time – everyone is different, so please don’t use our numbers for your own calculations. Track what you spend yourself and soon you’ll have a picture of how things look for you.

2017 Numbers

2017 Numbers

That’s incredible. Well done. We have started taking baby steps in tracking and controlling our expenses.. Fingers crossed for the future!

I, like you record all our expenditure, it’s somewhat laborious but vital if you want to keep within a budget. In conversation with many friends it’s very apparent most people haven’t a clue where they spend there money. Most know how much their mortgages are and may have a bit of a feel, rough estimates on everything else but ask them to drill down on their expenditure and its a finger in the air. I’ve been tracking now for 3 years and it’s really helped to eliminate wasting money. I’m impressed on the figure for the two of you for expenditure on clothes. I found my clothes took a battering, particularly undergarments, when washing them in the laundromats during our travels last year. This year to date I’ve already spent £66 on a pair of decent running trainers (half price as last year’s model), £45 on cord jeans(again reduced), £15 undergarments, and I’m no shopper. I find keeping a track on what we each spend on our different interests and hobbies quite revealing, as Martin Lewis quite correctly points out, “You don’t get fit by paying for gym membership”, something that has been a point of discussion in this household! 😉 Wishing you all the best for 2018.

Hi Megan. Yes it is certainly enlightening when you start to track where it all goes. The clothes budget is kept low by shopping mainly in charity shops, obviously not for undies though! Trainers are always less than £50, my current ones have been going for over a year and have seen me through a half marathon, at €20 from a shop in Portugal (emergency purchase when I realised my others were too small for longer distances!) I think their cost per kilometre must be amongst the best. Ju x

Thanks for sharing. One question you don’t seem to show any taxes in your costs. Are you not accruing for things like the new Section 24 (change in tax relief on buy to let interest) tax or taxes on dividends (although they could be sheltered in ISA’s)? I ask as taxes will certainly hit us in some of the countries we are looking at living permanently and so I build them into my cost planner.

We haven’t split out the taxes, but they (and NI contributions) are included in our fixed costs. As we don’t accrue, the taxes we paid in 2017 would be for the previous financial year where we were busy touring Scandinavia, so there was very little to pay. I suspect next year they will be more significant! We’ve researched Section 24 and have decided to take no action as we believe it will have minimal impact on us. We only have one buy to let mortgage in our portfolio which is less than half the value of the property, and as you can see from our income we’re a long way from earning £45k each! And as you guessed, our shares are all in ISAs (why wouldn’t you?) so they are sheltered. Taxes are built into our life experiment plans, as the saying goes: There are only two certainties in life…. death and taxes! Ju

Thanks for confirming Ju. Interesting that you don’t accrue. Final decision not made yet but I’m thinking of accruing and then keeping a balance sheet to smooth out the ‘big expenses’. Main contributors to the accrual were going to be home repairs/improvements where I was thinking to accrue at 1% to start with, vehicle assuming a 10 year life and taxes if we end up in an unfavourable country. Maybe I’m just making this whole whole financial independence thing too complicated…

We like to keep it simple. We have our ‘safety net’ for the sort of things you are mentioning. The safety net is partly cash in ISAs and partly in Premium Bonds, so all accessible quickly if needed but getting a low return compared with our other investments.

Pedro in the Midlands, Thank you for sharing, your example through this website is really inspiring.

I have found your spreadsheet took some time to tweak the other day but it does paint a picture to show how the goal of financial freedom with a purpose is possible. There are always “surprises” along the way, for example my wife has had her weekly hours of work reduced from 30 to 12 per week now that the Christmas period has passed so we need to be flexible in our income expectations. But we will try to keep a balance between paying off mortgage debt and saving for investment.

Thanks Pedro. Sounds like you’re on a great path, keep going! Cheers, Jay

Just added our diary to the packing list ready to track daily costs on our first big trip. Thanks for the reminder!

Hi Jay, been following your Blogs and your Vlogs for a lot of years now, even bought one of your books to read before we ventured to Morocco. We now have a property in Spain so work for part of the year in U.K. and spend the Winter in Spain, the Moho touring has taken a bit of a back seat recently but will hopefully come back to the fore in the not so distant future. We continue to maintain our spreadsheets but keep them separate, by doing this, like you, it helps us to forecast long term for our lifetime independence. Keep up the good work.

Wow that’s so cheap! We are about to do a trip for 6 months and hoping to stick to about 400 euros a week. I thought that might be hard but sound’s like you aren’t living like hermits!