Lessons Learned from 5 Years of Stock Market Investing

Three years ago we wrote about how we were risking our money in the stock market. Recently someone asked whether we’d written an update post and the answer was no, but it got me thinking it might be a good idea to pop something up share our experience over the past few years, so here it is!

Disclaimer

We’re investing amateurs. We have no formal training or qualifications in any form of investing and we are in no position to offer financial advice. Please treat this information for entertainment value only. If you do want to read up on stock market investing, we can recommend one book in particular: The Simple Path to Wealth. Although it has a US-focus, the book advocates a similar long-term, non-speculative approach to the one we’re taking (much of the information in the book is also available for free at jlcollinsnh.com).

Our Investing Goals

These are our main investing goals:

- We’re looking for a long-term return which, over a period of a decade or more, will beat inflation by 3 to 4%

- We’re comfortable with our capital increasing and decreasing in value over time (we think!)

- We have a wider portfolio of rental property, bonds, cash and pensions which we can rely on during stock market crashes

- We want a passive approach, we’re not interested in picking individual stocks or frequent trading

How We’ve Invested

This is how we’ve opted to invest in the stock market:

- We’ve opted to buy funds rather than individual shares

- We’ve invested through stocks and shares ISAs held with our bank

- We’ve bought passively-managed funds, rather than funds with an active fund manager

- Almost all of our shares are managed by Vanguard (we have a portfolio of funds, including VUKE, VHYL, VUSA and VWRL)

- We’ve chosen funds which are invested in physical shares rather than riskier synthetic assets

- We’ve opted to invest across the world, rather than only in the US or UK markets

- We’ve bought into funds which are invested in mostly large and medium-sized companies

- Our aim is to hold onto our shares for a period of at least a decade, probably multiple decades

- We aren’t currently taking an income from our shares, and are re-investing our dividends

- We’re making no attempt to ‘time the market’. We have zero idea whether the various worldwide markets will increase or decrease in the coming months or years

How Does this Earn us Money?

Shares aren’t like cash deposits in a bank. When we buy a share in a Vanguard fund, we’re buying part-ownership in tens, hundreds or even thousands of companies. From that point on we have a stake in the future of these companies. In return for owning their shares, companies often choose to pay out a percentage of their profits to shareholders, called a dividend. This money gets paid into our ISAs, every 3 months for our Vanguard shares. Over the long term we also expect our shares to appreciate in value, so we can hopefully sell some or all of them at a profit in the future.

There’s no guarantee that we’ll receive either dividend payments or see our shares appreciate. In fact, if we’re forced to sell our shares during a market crash we could lose appreciable amounts of money. However, research done on past performance of shares like the Standard & Poor 500 (the 500 biggest US companies) shows we can realistically expect a long-term return of 3% to 4% above inflation (a combination of dividends and capital appreciation). Read up on the Safe Withdrawal Rate or the Trinity Study for more information about the assumptions and probabilities involved in this thinking (one point to note: the study takes into account historical market crashes, so 3% to 4% is the worse-case long-term scenario).

Why Have We Invested Like This?

These are the reasons we’ve opted to invest in shares in the way we have:

- We believe it’s very difficult (impossible) for us to pick winning companies, so have opted for funds

- We don’t believe active fund managers can pick shares consistently either, especially with their costs taken into account, hence we’ve invested in passive funds. Passive funds try to follow an ‘index’, a logical grouping of companies like the FTSE 100, rather than trying to guess which of these 100 companies will outperform the others

- Passive funds are much cheaper in terms of fees than active ones. We’re paying between 0.09% and 0.29% a year to Vanguard for these funds, while active funds can easily cost 1% or more. The difference looks small, but over the long-term it translates to savings of thousands, or tens of thousands of pounds

- We’re comfortable with a relatively conservative long-term return

- We’re comfortable (we hope) with the idea our shares will probably halve in value during crashes, and might not regain that value for another decade or more

How Have Our Shares Performed?

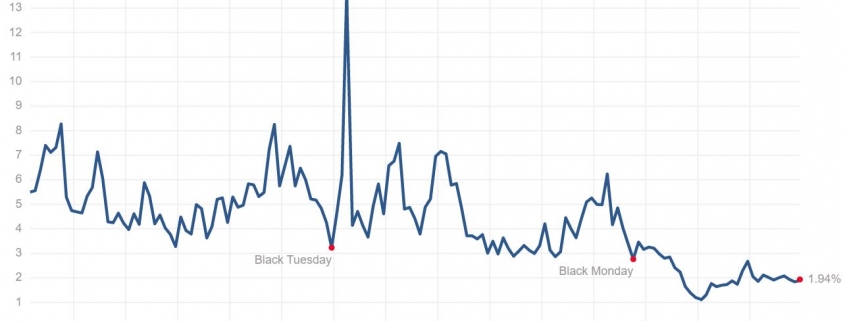

To be honest, it’s far too early to say. We’ve only owned them for five years and in that time most stock markets around the world have been steadily increasing in value, with a few dips here and there. Our shares have also increased at a fairly steady rate, as they should since they’re in passive index-trackers, certainly more than the long-term average we’re expecting to see. It doesn’t seem to be widely reported but, for example, the Standard & Poor 500 is currently valued at double what it was at the peak before the financial crash of 2008.

I’m not suggesting this growth will continue. No-one knows what will happen with the UK, US or world stock markets, but it seems safe to assume there’ll be more crashes in the coming decades. Our aim during a crash will be to do nothing. Research has shown most people lose money during crashes not because the market has dropped, but because they sell their shares at a low price. Who can blame them when they may have seen their nest egg eroded over many months to half it’s worth with no end in sight? The issue is those who eventually panic and sell only buy back into the market once it’s increased past what they sold their shares for, locking in the loss. We’ve also mitigated the risk of our shares becoming worthless by buying funds rather than individual companies: the chances of all FTSE 100 companies going bust at the same time is pretty small.

Riding out this kind of financial storm will be easier said than done, of course, hence it’s too early to say how well our shares are performing. Perhaps the question should be ‘how well are you two performing?’ In which case we could say we’re doing fine, but times are good and easy at the moment, we’re living through one hell of a bull market. Once the market turns and goes bear (starts dropping like a stone), that’s when the real test comes. From a dividend perspective, we’re seeing returns of roughly 3% on our original investment amount (closer to 2% on the current value of the shares), so we’re getting what we expected there.

What’s Next

Pretty boring stuff I’m afraid, no ‘BUY, BUY, BUY!!!’ or ‘SELL, SELL, SELL!!!’ here folks. We’ll continue to trickle money into our shares while keeping a good-sized emergency fund in cash and bonds. This fund **should** be enough to pay for repairs to our properties and other one-off costs without forcing us to sell any shares. While selling shares wouldn’t be an issue at the moment, being forced to sell them during a crash would see us losing significant capital, which obviously we want to avoid. We’re also looking at shifting some of our higher cost/lower value pensions into SIPPs (self-invested personal pensions) so we can reduce our fees and the complexity involved in these pensions, and ensure we can gain access to them from age 55. Some experience of stock market investing will prove invaluable in taking this risk.

We’ll also need to look into buying ‘real bonds’ rather than the premium bonds which we currently hold. By ‘real bonds’ I mean a bond fund which we can use alongside our shares to buffer out the larger stock market drops in the future. We’ll probably choose to do this as we get older, especially if we opt to sell one or both of our rental properties and move the money into equities and bonds.

Cheers, Jay

Fingers crossed for the next decades. The simple path to wealth is a good guide. Just remains to be seen if we can sit out the drop. Thanks again.

Hi Jay, great post and good to get an update. Who have you used to buy and hold your Vanguard ETFs?

Here in Ireland they are treated like investment funds, 41% tax and must be exited after 8 years! I need to invest via the UK if I can.

Hi Mr D, we can buy our funds through our UK bank. Vanguard sell the funds directly too, but their platform is more expensive than our bank’s share trading platform. Wow, 41% tax = find another, more tax-friendly investment. Cheers, good luck, Jay

Hi Jay

Like you I am not an investment advisor but I also have invested in equities over the last 5-6 years, although take a different approach to you. I invest in actively managed funds and pay the additional fees based on the higher returns I do receive. I am in two funds, one which grows in value as it pays me no direct dividends and another which pays me 1.5 percent return per quarter (6 percent per annum). Any additional return over the 6 percent, is retained in that fund to grow my equity. In the time I have been in them they have both performed extremely well, although in the last 18 months I altered my appetite for risk and the returns have diminished marginally. I did this due to reaching 60 and retiring. I believe investing is all about horses for courses, my risk appetite may be a little higher than some and I also accept the value of my portfolio fluctuating with market conditions, these are long term strategies. I use property for my short term investments. Whats important is that people decide what their appetite is and carry through.

We are now back in NZ, our motorhome is crossing the world to join us here in mid September. We are already planning our next european moho tour in 2021.

Cheers

Frank

Great stuff Frank, good luck and happy travels! Jay