What is Financial Freedom?

This blog post was originally written for a sister website called The Matrix Experiment. We set up the site in January 2017 to pass on financial hints and tips we’d learned as we became financially free. The Matrix Experiment site no longer exists, so we’ve incorporated this financial information here.

I’m 44, live in the UK, and I never need to work again for money.

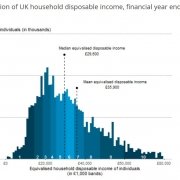

I have income from various investments which, with a good degree of certainty, will pay me to live, travel, volunteer, whatever I choose, for the rest of my life. If I’m lucky, I might have 40 years of such financial freedom. Some folks call it financial independence, some shorten this to FI, yet others prefer FIRE (financially independent, retired early). Yep, there is a community of people across the world who are already FI way before ‘normal’ retirement age, or are actively working towards it. I personally don’t consider myself ‘retired’ by the way, since that implies being relatively inactive, while I want to increase my levels of personal activity and social contribution as my life goes on. I also enjoy some types of work, like writing this blog for example.

My wife and I have been living this weird jobless reality for the past 15 months since we reached the point the money coming in from investments covered all of our outgoing costs. It still feels unreal, to have shifted from corporate jobs with monthly salaries (I was an IT project manager, my wife ran a marketing team) to no jobs with passive income covering our costs. We keep a close eye on our income and expenditure, and since finishing work have seen our bank balance gradually increase in size.

What are these magical investments which generate our income? Nothing weird or wonderful about them: we own and rent out three properties in the UK, mainly houses which we bought, lived in, did up and then moved on to the next one. We also have smaller income streams from solar panels on two of the roofs (the government pays us for the electricity they generate), shares, and advertising income from blogs we run. We’re by no means investment gurus and I’ll use this blog to explain how we bought and operate our investments, and how anyone able to free up enough cash should be able to do the same.

OK, I’ll keep this one short. The above is a brief but accurate description of what FI is. Getting to the point of FI required from us a change in mindset which took us a few years to achieve. We had to learn about personal finance. We sold our unneeded possessions. We downsized our living space. We found and used sources of motivation to keep us going when times got tough or when the whole plan seemed quite mad. We worked as contractors, learning about risk and reward in the process. We had to build the courage to take personal control of our finances and our wider lives (something we’re still working on).

I’ll do my best to talk you through all of this in later, more detailed blog posts. I’ll try and do it in such a way the lessons we learned are useful to you, to help you along your own path to freedom.

Cheers, Jason

Leave a Reply

Want to join the discussion?Feel free to contribute!