The Luck Which Helped Us Retire Aged 43

I’ve been spending more time thinking recently, an unexpected gift from being in lock-down, about how Ju and I ended up being able to stop working in our early 40s, how we got financially free. It should be obvious perhaps, since we lived through the process of simplifying our lives and getting our finances in order. Over the years I’ve found I needed to be more introspective about it though, to look deeper.

When our story popped up in abbreviated video form on the BBC a couple of years ago, we got to see how the general public perceived what we’d done. It was a sobering experience as the social media comments streamed in, a good one in retrospect as it enabled us to get an impartial view of ourselves. Many of the comments were positive, saying our approach should be admired, paraphrasing: “they saved, they avoided buying stuff they didn’t need, they invested, they made use of the system we all live in to gain their freedom from it”. “Good for them”.

There were also a fair few very negative comments which I’ve since written off as ill-conceived or the result of jealousy. Perhaps the most interesting and challenging ones were the more neutral ones: neither supportive nor attacking, saying good for us, but we only did it because we were lucky in some way. This sense that our early retirement was a result of luck was, if I’m honest, an irritation!

We’d been working towards financial independence, albeit without always knowing the end result, for a decade. We’d forced ourselves to track our spending and to learn about personal finance. We’d worked to understand our own behaviors around money. We’d talked about it as a couple, aligning our life and financial goals. We’d overcome fear to start deliberately investing in residential and commercial property, solar panels and stock funds. To us, it wasn’t luck: we earned it. At least that’s what I used to think.

The deeper I think about it, and the more reading I do, the more I realise luck was definitely involved in our story, only perhaps not the kind of luck some might expect (no lottery win, no inheritance, no viral YouTube video, we didn’t invent anything etc). Yes, we earned above-average incomes, particularly in the later years of our careers, although we’d both argue there was far less luck involved in that than some might think. To us it was the end result of years of hard work, risk taking and determination, but we’ll leave that argument for another time. Sure, we have no kids either but (a) lots of financial independence bloggers do have kids and (b) it’s not luck we don’t have ’em, it’s called contraception folks :-). Yep, we’re white-skinned and happen to be brought up in one of the richest nations on Earth, but so were many thousands of people around us and few folks are looking at retiring so early (many don’t want to, but I imagine some would). So, where did the luck come in? Let’s have a look.

Stroke of Luck 1: Where We Live

OK, before I run through my thinking on this one, have a play with the ONS tool embedded below. It colour-codes areas of the UK to show the average ratio of house price to income in England and Wales. For example, if it shows your area as light green, then the average house costs between 5 and 8 times the average income where you live. You can also play with the timeline, so you can see how this ratio has changed since 1997 (clue: houses are now much less affordable now than they used to be).

You might already be able to guess where I’m going with this one. Neither Ju nor I moved to Nottingham, we were brought up here. My folks moved here when I was 4 so my dad could go underground, working the face in Moorgreen Colliery (since demolished in 1986, and my running club now competes in a monthly 5K race where it stood). Ju’s folks came from Scotland for Ju’s dad to work in the hosiery industry, where he had to drive endlessly across the UK visiting factories. Our parent’s choice of location has helped us in two ways:

Firstly, let’s look back at the map. As of 2019 you can draw a line across England, roughly from the Wash to the Bristol Channel. Below that line houses are harder to buy than above it. I’m simplifying things, but that’s the crux of it. If you live in the south-east you (statistically speaking) might to be earning more money, but the additional wonga will be more than eaten by your mortgage (or will sit in your home as capital, earning you no income). Where we live in the Broxtowe area houses cost on average 6.8 times income in 2019. We’re close to the edge of the cheaper Nottingham area though, where the ratio is lower still at 4.9. Around London the ratio is between 10 and 15, effectively you’re having to pay for your home twice compared with where we live in the East Midlands, adding many years to the average, more southerly denizen’s working life (unless you sell up and move somewhere cheaper).

Eyeballing Zoopla, a three-bed semi around where we live is about £170,000, and a two-bed home can be had for £90,000 to £100,000. The average house price in NG16 is £187,000. The city of Nottingham is a short commute away, covered by frequent public transport, with a wide variety of well-paid job opportunities. Derby is a little further away, but I commuted there for a year (enjoying traffic-busting on my 100cc motorbike), to a well-paid job as a technical writer. Put simply, this is a naturally good place to live if you want to retire early.

Secondly, this area has working-class roots. The coal mines, breweries and hosiery factories are long gone, but the mindset remains. This ain’t Kensington folks. There are relatively few Porsches and blacked-out Range Rovers gracing these streets, and no-one bats an eyelid at us driving about in Ju’s mum’s 20-year-old Corolla. That’s not to say there are no new cars or status brands knocking about (it’s not the Bronx either), but we personally feel absolutely zero pressure to demonstrate any wealth status with a car, house, clothes, jewelry, watches and so on. In turn this made it far simpler for us to save money and to keep our lifestyle costs low while feeling no deprivation whatsoever (we feel the opposite: liberated).

As an aside, there’s one aspect of our location which we did deliberately engineer; this part wasn’t luck. Back in 2015 when we bought out current home, we opted for a side street in the town-centre. We live within a few minute’s walk of several restaurants and pubs, a Sainsburys, Boots and Wilkos, a retail estate (dominated by IKEA), the local leisure centre and gym, paths in the countryside, and the main bus route which takes us into the city in about 20 minutes. All of this reduces our need to use a car, which in turn has a big effect on our costs and quality of life (in this we were influenced heavily by Mr Money Mustache, although we don’t cycle as much as he does, and have never hauled a washing machine home on a bike trailer).

Stroke of Luck 2: Frugal Folks

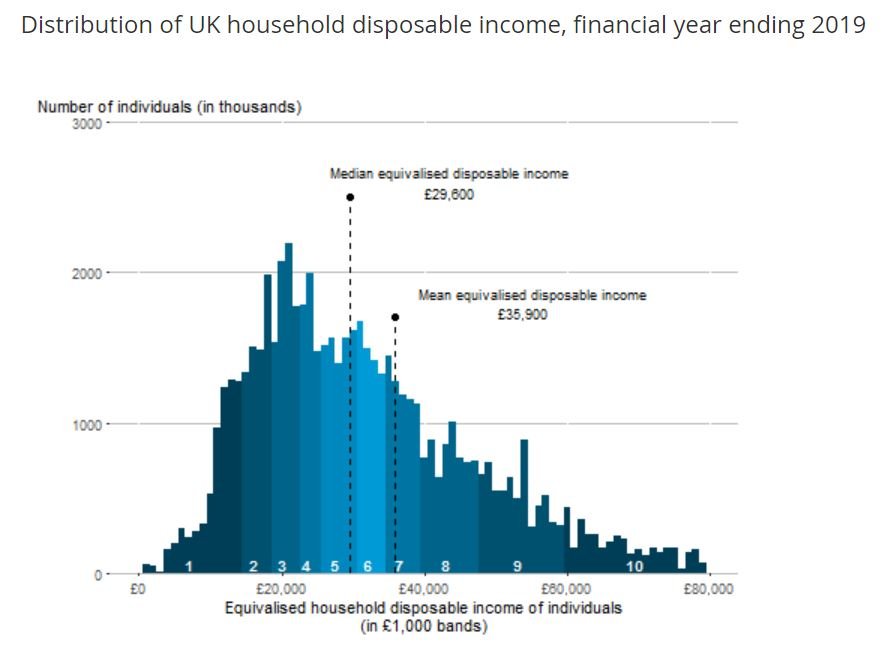

While re-reading the seminal Your Money or Your Life for the third time (I’ve a short memory), it struck me just how lucky we’ve been to have a frugal upbringing. Ju and I have opted to live on a relatively small budget, we get through around £20,000 a year. That’s a choice for us: we could go back to work and earn more so we can spend more. For our parents (and lots of other people of course), this kind of ballpark budget wasn’t a choice: it was all they had. At present the average household disposable income is £29,600 a year in the UK, and half of households earn less than this. From that they need to pay any rent/mortgage, commuting costs and for any children, none of which we have. We also still save some of our income, so earn more than £20,000 a year. My guess is we live on roughly an average household income in the UK, perhaps a little less.

This reality made it very weird to read the sub-headline of this article written about us in the Daily Mail: “you’ll have to make Scrooge look like a shopaholic”. I get the point: it wasn’t the fact we didn’t spend much, it was that we went against the grain and didn’t spend 90 to 110% of our income, which is now considered the norm. But hey, we’re probably spending more than at least a third the country does, over 20 million people: hardly Scrooge material? There’s a breakdown on what UK households spend their income on here, if you’re into your stats.

Just how frugal was our upbringing? It didn’t particularly feel it at the time to me. My dad was literally starved as a child, leaving an abusive home as soon as he could to be an apprentice farm worker, where in turn he wasn’t much better treated than a slave. Mum was effectively orphaned at 12 when her own mum died and her dad left her and her siblings with her grandmother. In stark contrast I had everything I needed, a ZX Spectrum (that wee thing eventually helped me into a career in IT), membership in the Cubs, camping holidays and later on holidays abroad, my parents had a car (which dad maintained in the street, changing the oil and brakes and the like) and we were kept warm, well fed, clothed and safe. I admit I wasn’t always grateful though! Both my parents worked when my sister and I were in school, and clearly money was tight. They grafted and grafted and grafted, and eventually went from a tied cottage to a rented council house, to a terrace, to a paid-off three-bed semi with a driveway and garage and nearly-new car.

Ju’s parents have a tongue-in-cheek family motto: “every penny’s a prisoner”. They’ve worked hard too, and have been and remain very careful with their money (which we like, we enjoy spending time with them). We joke it’s the Scottish blood which flows through her dad’s veins, they have a reputation for canny spending, the Scots. Money was simply something which was difficult to come by in their time (unlike ours, we worked hard but nothing like as hard as our parents). They see money as something which needs careful management, it won’t just look after itself, and that’s flowed down into our veins too. That single stroke of luck probably enabled us to avoid an entire decade or even two of commuting and sitting in office cubicles.

Stroke of Luck 3: We’re On the Same Page

Ju and I have been together for 15 years and married for 13. When we met we didn’t sit down and discuss finances. We didn’t agree a life plan saying we’d be retired in our early 40s, on our first date! That stuff all came much, much later, so although there was probably some subconscious selectivity going on, who knows? We were lucky, I think, to have ended up being able to align so well with regards to money and lifestyle.

We did start up a joint bank account fairly quickly after meeting one another mind you, and almost as quickly binned off the idea of having separate accounts. Each to their own in this, of course, but for us it was too difficult and contentious to try and allocate ‘shared’ life expenses. Having one single bank account gave us transparency of our joint finances and a level of trust that continues today. From there our path took us down the ‘usual’ route of ‘climbing the housing ladder’, buying a much bigger property than we needed with a pretty hefty mortgage. It was a shared and agreed choice though, as was the eventual one to reduce our costs, pay off the mortgage, rent it out and leave our corporate jobs in our late 30s and go travelling in an old motorhome.

When we returned home, we made the joint decision to head back to jobs we didn’t like in order to get into a stronger financial position faster. We jointly drew up, reviewed and amended plans to save and invest, and we jointly threw ourselves into the challenge. Once we’ve built up enough passive income to retire, we jointly took the decision to quit (this free eBook outlines the story). Since then we review our income, costs and what we own and owe at the start of every month.

With all that said, we work with money in different ways. Ju does the bulk of the day-to-day management. She pays the bills and keeps detailed records of everything we earn and spend. Everything, down to the penny. If this sounds like some serious dedication to you, it does to me too, I can’t be bothered with that! I’m very glad she does though, as she also categorizes it all which makes filling in tax returns a lot easier. Also, while we don’t have a budget as such (we have an overall yearly amount we’d like to stay under, but don’t budget say £100 a month to eating out etc), it’s very useful to see where all the money came from and went. She’s been tracking like this for over a decade now, but it still seems like a force of nature how several small costs add up to one big one at the end of the month. I come at money from a wider perspective, reading up on investing behavior and strategy, tax, pension management, long-term planning and the like, none of which Ju enjoys. I can’t say I do a massive amount of this though, and Ju has to have the credit for the bulk of the effort.

We don’t argue about money. We don’t try and hide from it either. If one of us wants to buy something (other than the day-to-day stuff like food) we tend to wait a few days or weeks (months sometimes) first. If we still want it after that, we talk it through with each other. More often than not those two checks result in us not buying (we use what we have, rent, borrow or make). If we do buy, we usually try and avoid buying new (we look for reconditioned, or second hand) or buying more than we need (buying quality makes sense, buying the top model usually doesn’t).

Stroke of Luck 4: Two Years in a Motorhome

Back in 2011 when we bought Dave, our aged yet capable motorhome to whisk us off away from the corporate world, we’d no idea where he’d take us, both literally and figuratively. We’d owned a camper van before and travelled the UK and Europe in it, but only for short holidays, and it was a mystery how well we’d cope long-term in such a tiny space.

In the ensuing two years of travel we discovered that we enjoyed self-determination far, far more than we enjoyed the income and status of work. No-one telling us when we could have a day off work, what we could and couldn’t say or wear or instructing us to do stuff which went against our values. There were ‘hardships’ involved, as many motorhome tourers will attest: there are inevitable occasional pressures involved in two people and a dog living in a 2m by 6m space, needing to empty a box full of poop every few days, trying to get repairs done in a foreign tongue, cramming food into the world’s smallest freezer, frequently sleeping in car parks and occasionally putting up with the ‘neds’ (the ‘youf’ playing banging tunes next to your head at 3am). Ju cut my hair with dog clippers and scissors. We wore our clothes until they fell apart. We set up our gadgets to use the bare minimum of internet bandwidth to save a few quid. And guess what? We loved it. All of it. Except the neds, we didn’t like the neds much and these days spend more time on aires and in campsites to avoid ’em!

Those two years were a test. We didn’t expect or plan for the test, it was a stroke of luck that it came our way, demonstrating to us what was important: time to see the world, to breathe it in, to swim in the clear blue sea and walk mountain paths. We learned we didn’t need anything like our previous level of income to be happy. Life on the road also introduced us to people who gave us a completely different perspective on how they worked with money, planning carefully for years to achieve their goals. We met incredibly positive people who fueled our passion and made us believe we could achieve our bonkers plan to get free, another utter stroke of luck.

Summary

Summing up, yes, we’ve been very lucky in our lives. As well as the points above, we live in the UK so aren’t tied to a job for health insurance or exposed to to the cost or risk of living without it, like in the US. We’ve had good health, which has enabled us to work consistently and without needing care. My parents helped pay my way through university, before tuition fees were introduced (Ju went to the School of Life, and paid her own way through nightschool). We bought our first homes before the big price rises of the 2000s (although we also bought by far our most expensive home just before the subsequent crash, negating much of that advantage). While we definitely worked hard on our careers and on ourselves to get where we are, we’re also very grateful for the luck we’ve had.

Cheers folks, Jay

A very interesting article Jay, there is the expression that you make you own luck and you guys certainly have and totally deserve it.

Regional variations in house prices, are a key factor in life choices, as you rightly point out.

I am being rather generalist but from my experience, living and working in London and the South East, is just a rat race at times, where paying the mortgage and bills, is typically a matter of keeping your head above water, at least until the mortgage is paid back. The only benefit being the equity in the property once debts are paid off but this is only of benefit if you sell up and realise your asset.

For those that rent in the South East, who are not on high income, it’s not so rosey, as the bulk of their income goes on the rent and very little is left for the nice things in life or future planning.

Through my work as a garden designer, I was fortunate to spend 10 years visiting various health trusts around the country advising and funding ‘enhancing the healing environment’ schemes for the Kings Fund, it was all voluntary but I was amazed by the fiscal differences of those working in the health sector around the country, where incomes where broadly the same.

For example, I would visit teams in the areas where house prices were lower, especially the Black Country and they seemed to have a great life, their mortgages where often paid off by their late 30’s, they seemed to be much more contented in life, indeed, it would be true to say that they enthused in life away from the workplace and often had caravans, motorhomes and holiday homes abroad. I had no pangs of jealousy at their apparent good fortune but it was in stark difference to the stressful ‘hamster wheel’ life that I saw in areas of supposed wealth and higher house prices, where work and finances seem to dominate lives…

Thank you once again for yours and Ju’s candid thoughts, I always read all your articles with interest and finally have a ‘post mortgage’ trip to Norway planned, albeit firmly on the ‘lockdown’ back burner at the moment.

Jeremy Salt

Hi Jeremy

Thanks for taking the time to write and share your experience/perspective, very interesting and useful. Once the world opens up I can’t think of a more dramatic country to visit that Norway; the landscapes blew my socks off time and again.

Cheers, Jay

Thanks guys – my wife & I have followed a similar path as you. We “retired” at 46 and went off round Europe in our moho. I agree with you that there’s some luck involved, people still say “your so lucky ….” but much of it is about choices. You don’t need a bigger house, new car, massive TV etc. These things are just fuelling someone else’s early retirement with your money! Keep safe & stay “lucky”

Ian, we of the same mindset fella – you can make (at least some of) your own luck! Great to hear you’ve pulled off such an early escape. Cheers, Jay

What a great story of how to achieve your dreams. Being without a mortgage is a great achievement, it certainly does remove a huge slice off your monthly expenditure.

My wife and I bought a plot of land to build on, we had money saved, but not enough to build. In stepped my father and father-in-law with a loan. When we completed our bungalow we had £68 left in the bank.

As we were getting on our feet and ready to pay back the loan, we were told by both of them to forget it. Now that was luck!!. This enabled us to do things we would not otherwise been able to afford.

Had two children and a caravan, so holidays were now taken care of. Our children are now your age and we are a bit long in the tooth. We now have a motorhome and would now be in Spain for 10 to 12 weeks if it wasn’t for this lockdown.

Keep safe and enjoy your travelllng, we will follow with great interest.

Hi Jay,

I’ve enjoyed very much reading your blog having stumbled on it over the last few days. It’s planted a seed with me about whether it might be possible for me to bring forward my retirement in the same way you have. What an exciting thought! Thank you too for opening my eyes to this as a possibility. I would have a lot of planning to do to work out if it’s indeed a possibility and how/when to achieve it, but I love the spreadsheets and data you’ve provided!

I enjoyed this particular article, as it’s something I often think about myself. How much has luck paid in putting me in a position where I am reasonably comfortable, so much so that I could even consider this as a possibility? I’m probably similar to you in some ways – I’ve not had any hand-outs in life, and I’ve also worked very hard for what I’ve achieved, but at the same time, I feel very lucky that my life choices have paid off, that I live in the UK and that I had an upbringing which set me up to be successful in life (my folks weren’t wealthy themselves and worked hard for what they had, but I grew up with the mindset of optimism and never questioned that I would be able to achieve the things I wanted). With the benefit of hindsight, some of the unplanned choices I’ve made have paid off handsomely, and some of those seemingly inconsequential decisions could have made a big difference if I hadn’t made those choices when I did.

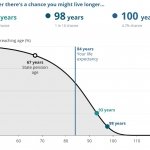

I also count myself very lucky when I see the poverty in other countries, where people simply will never have the options to do the things that I have. Looking at your graph of UK disposable income, I bet that if you compared that data world-wide, most people from the UK or similar countries would fair very well, and be in the top percentiles, simply because of our country’s relative wealth to the rest of the world.

So, in some respects, maybe I have won the lottery – the lottery of living where I do, and for the society/upbringing that are a part of me. I have to confess that this gives me a certain amount of life guilt, especially when travelling and seeing first hand the inequalities in the world. But perhaps this can be offset by being kind to people and trying to make a positive difference in the places I go and to the people I meet.

Thanks again for the informative writing and best regards.

Thanks Cheryl, lovely message to receive. I feel the guilt too but feel the best I can do is just try to be a decent person. Take care, happy travels, Jay

great blog, and very informative piece. Taken a lot of inspo from this blog for our own retirement blog!

Thank you!