A Year of Financial Freedom, Are We Losing Money?

On 31 August 2015, we wrote on this blog that we’d hit the tipping point at age 43: we had enough income coming in from passive streams to cover our ongoing costs. In other words: we didn’t need to trade our time for money any more, we could travel or live in the UK without having to work, ever again (this is how we did it). It’s been just over a year, so we thought it a good time to pop up an update.

On 31 August 2015, we wrote on this blog that we’d hit the tipping point at age 43: we had enough income coming in from passive streams to cover our ongoing costs. In other words: we didn’t need to trade our time for money any more, we could travel or live in the UK without having to work, ever again (this is how we did it). It’s been just over a year, so we thought it a good time to pop up an update.

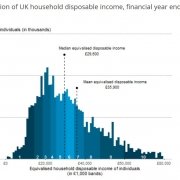

If you’re not interested in the detail, our income for the last 12 months (which came mainly from letting out UK property) was £31,561.20 and our expenditure was £24,294.86. We’re £7,266.24 in the black, although we’ll need to accrue some of that for future replacement and repair of expensive items. For example, our motorhome will have depreciated, and the gas boilers in our properties will be a year closer to needing replacement. That said, we’ve assumed the value of our properties hasn’t changed. If they increased by 3% over the past 12 months, we’d have ‘earned’ roughly £12,000 (before tax) in those months.

In summary: we’re right on track. If we continue to manage our costs at this level, we shouldn’t need to ever go back to a job again. As before, we’re not saying we won’t, just that we won’t be forced to by the need to earn money. The big question, are we enjoying life? You’ll have to read this blog to know the answer to that one!

If you are interesting in the detail, there are more numbers below. A quick bit of explanation follows so those numbers make more sense:

- We have three residential properties in the UK

- We let two of them out. One has a mortgage on it, the other is paid off

- We let out bedrooms in the third one, but keep a large en-suite bedroom for ourselves. The income we receive for this property (shown below) has been reduced to take into account Council Tax and Utility Bills, so that’s why those costs aren’t listed

- One property has a small shop embedded in it, which we let out separately

- We use local management agents to handle the house and shop lets

- We travel extensively in a motorhome in Europe

- We do very occasional web work, just a few days

- Two properties have solar panels on the roofs, and the UK government pays us for the electricity they generate

- We hold shares inside ISAs which we receive dividends for

- We hold cash (which we receive interest on) and a small number of Premium Bonds, for emergency purposes

- We declare all income on personal tax returns, and all income is split 50-50 between us to make the most of our personal tax allowances

- We have personal pensions, but can’t start to receive any income from them until at least 2027

- We no longer make personal NI contributions, opting to self-invest any excess money we have instead

So, our income breakdown is as follows:

| Amazon Associates | £883.01 |

| Book Sales | £317.69 |

| Google Adsense | £688.06 |

| Interest | £426.83 |

| Premium Bonds | £25.00 |

| Presents & Refunds | £1,808.34 |

| Rental Property x3 | £22,460.00 |

| Selling Our Stuff | £1,268.02 |

| Share Dividends | £885.07 |

| Solar Panels x2 | £975.01 |

| Work | £1,824.17 |

| TOTAL | £31,561.20 |

And our expenditure, which includes a mixture of travel costs (293 days travelling in the year, 72 days in the UK), tax and costs to maintain our UK-based properties is as follows:

| Bank Fees | £34.64 |

| Bus/Train | £138.38 |

| Campsites | £805.80 |

| Car & Motorhome Insurance, Tax & Breakdown | £492.15 |

| Car & Motorhome Repairs & MOT | £2,095.67 |

| Charity | £61.00 |

| Charlie the Pooch – medication / vets fees | £284.66 |

| Clothes | £438.92 |

| Communication – top ups / data | £494.30 |

| Daytime Parking | £25.02 |

| Diesel & Petrol | £1,872.00 |

| Eating Out – meals, snacks & drinking | £1,578.83 |

| Ferries | £615.39 |

| Healthcare – Dentist / Perscriptions / Gym etc | £133.16 |

| Hotel (for Hen Do) | £110.00 |

| Insurance – Travel | £412.34 |

| Laundry | £151.27 |

| LPG | £186.70 |

| Motorhome Storage | £330.00 |

| Paid Aires | £373.83 |

| Personal Tax | £1,464.90 |

| Presents | £385.55 |

| Rental Property Costs – Repairs/Agent Fees | £6,498.07 |

| Service Points for Motorhome | £12.57 |

| Souvenirs | £26.99 |

| Supermarket Shopping | £3,051.56 |

| Supplies/Misc | £383.56 |

| Tolls/Vignettes | £96.88 |

| Tourist Attraction Entry Fees | £379.61 |

| Website Hosting | £47.29 |

| Work Expenditure – Accountant Fees/Insurance etc | £1,313.92 |

| Total | £24,294.96 |

If you’re interested in how all of this madcap Financial Independence stuff works, we’ve put together a free mini-guide on how we did it, which you can download in various eBook formats here. We can also highly recommend the Mr Money Mustache (US-based) and The Escape Artist (UK-based) blogs.

Thanks, Ju and Jay

Not sure I’d want my finances on public view, to top marks for openness. This post given us a great lift. We are new to this life on the road, but over the last 12 months we’ve managed on a budget of under 12k. of direct cah out-lay, without resorting to eating ‘road-kill’ or stealing eggs. Over 15,000 miles, 10 European and 2 Non-European countries. We see and meet, some folks who NEVER visit a camp site, NEVER use a laundry and NEVER pay for parking. But I’m not so sure their lives are as colourful as ours, but it shows it can be done and it shouldn’t cost the earth, it just depends what you want out of the trip and your expectations are. Kindest, Wayne.

No-one wants their finances on view mate – but that makes it so hard to get a handle on whether this kind of life is possible for others. Without publishing some of the detail, folks just believe that somehow we’re doing something ‘weird’ or we’re not telling the whole story. Media stories which imply it’s impossible to retire before your state pension age, and financial industry stories about life being awful in retirement unless you have something near your pre-retirement income don’t help. We’re trying to get the message across that we’re not doing anything wildly crazy here: we’re living what we think is a pretty fantastic life, before we’re too old to fully enjoy it, and we don’t spend much money to do it. Cutting out the property management costs, and some other one-off costs which we incurred last year but shouldn’t see again in future, we’re getting through abut £15k a year travelling, which is more than most folks we meet doing the same thing, but is roughly the UK poverty line income all the same. Cheers, keep pushing on guys! Jay

Imagine someone reading your blog and trying to follow in their footsteps, what amount of capital must they first earn or save to be able to generate the same amount of passive income in order to be ‘financially free’ ?

In other words, if you sold off all your property (and repaid all your mortgages) what amount would you be left with in the bank?

That’s a figure I could work to and know, if invested right, I could live a similar lifestyle.

Hi Graham, MMM can answer this one far better than I ever could.

http://www.mrmoneymustache.com/2012/05/29/how-much-do-i-need-for-retirement/

Cheers, Jay

Looking at your accounts.

Your tax is as much as your accountant?

Why do you need them?

Do a self assessment and save money.

Also your property management fees are 25% of income from property why?

Thanks John

Hi John.

We were running a Ltd company so had final accounts to do. Property management includes repairs, gas certs, fees for finding a new tenant for our shop etc.

Cheers, Jay

We’re planning to do something similar in a VW Camper, which I suspect is tad smaller than your motorhome.

Our next trip will be to Sicily over Christmas this year. No dog and no children. They both think we’re completely balmy. Maybe they’re right, but we think it’s going to be an amazing adventure. Starting by the way from Switzerland and planning overnight down the Italian coast.

Cracking!

Just a huge thank you for an incredibly inspiring blog. We are leaving the UK in our motorhome (yet to be bought!) in January for at least two years but probably longer depending on how we can stretch our budget. We’ve been desperate to long term travel again since our year out backpacking in 2012 after ten years of work but realising the opportunities afforded by motorhoming has made us believe we can do it for a much longer time – maybe even forever which is truly living the dream!! Your tips for financial freedom are always in our minds at the moment as we think through all the options for creating passive income and we’re sure we’ll make it happen. Lovely to read about a couple who thinks about money, travel and life like we do – which is not that common in our experience! P.s. these financial breakdowns are invaluable

thanks for writing this, I have just subscribed!

I am in a similar position though about 2 years away ( from my workings out anyway) We live and work in Hong Kong and are lucky enough to have a decent salary and own a house here which we are in the process of selling. Although we don’t have the stones to take off driving into the sunset we will be saying farewell to the 9-5 ( or the 7 -7) as it generally turns out to be and heading to different places for 2 or 3 months each time.

We are doing the rental and dividend way as well and the next two years are to check the income of it while i finish up a contract. Reading the advice and your experiences is making me much more impatient to do it. Thank you for doing this and sharing your story with us all.

You’re very welcome Marc, good luck, keep pushing on sir! Jay

My initial reaction to this blog was “why should I read about someone else having fun whilst helping to fund their lifestyle by reading it?”. I still feel a bit this way, and in all honesty I find the numerous pictures of you guys having fun a bit galling! :) However I take my hat off to you for actually doing something that others only dream of, and thank you for being so honest about how you did it and your financial situation. If I sold my house and paid off the mortgage my net worth (excluding pension) would be around £500,000 so in theory I guess could do what you are doing, but sadly I have a three year old which makes the idea rather difficult to say the least. However, you have put an itch in my brain which needs scratching, so I may yet come up with a plan.

Good luck and all the best.

Rob

Seems a reasonable reaction Rob, I would have felt the same a while back. The ‘itch’ you mention is the reason for us doing this stuff, we knew it would generate a lot of negative comments, but wanted to simply highlight this is possible. Is it possible for everyone? IMHO, no way. One reason people often cite is having children, but this guy hit FI at 43 with 3 children:

https://theescapeartist.me/about/

My feeling is this option is out there for at least some of us, but if you don’t even know you can do it, it seems entirely impossible.

Cheers, thanks for commenting, Jason